Fox, Big Ten made a big bet on TV future; it paid off with huge contract | Opinion

The Big Ten’s big bet paid off Thursday.

Fifteen years ago, when the conference first formed the Big Ten Network through a joint venture with Fox, the Big Ten was told it was embarking on a fool’s errand. Not enough people would want that much league-centric broadcast content, and what consumers would want, the Big Ten would pay for siphoning off traditional partners, most notably ESPN.

The Worldwide Leader was a monolith then. It dominated the college sports broadcast landscape, had the biggest and best national print-digital machine, and was so multi-platform it even boasted a magazine and a radio network.

No one, it was believed, could take on ESPN. It had no peers.

It has one now.

Truthfully, we probably overstated ESPN’s position then. But the Big Ten broke its hegemony on college sports — crucially, college football — as we expected it would, when the league announced Thursday a seven-year, three-network media rights package that will pay more than $1 billion annually, and does not include ESPN.

When combined with Big Ten Network revenues, annual per-school distributions are expected to push, if not pass, $100 million.

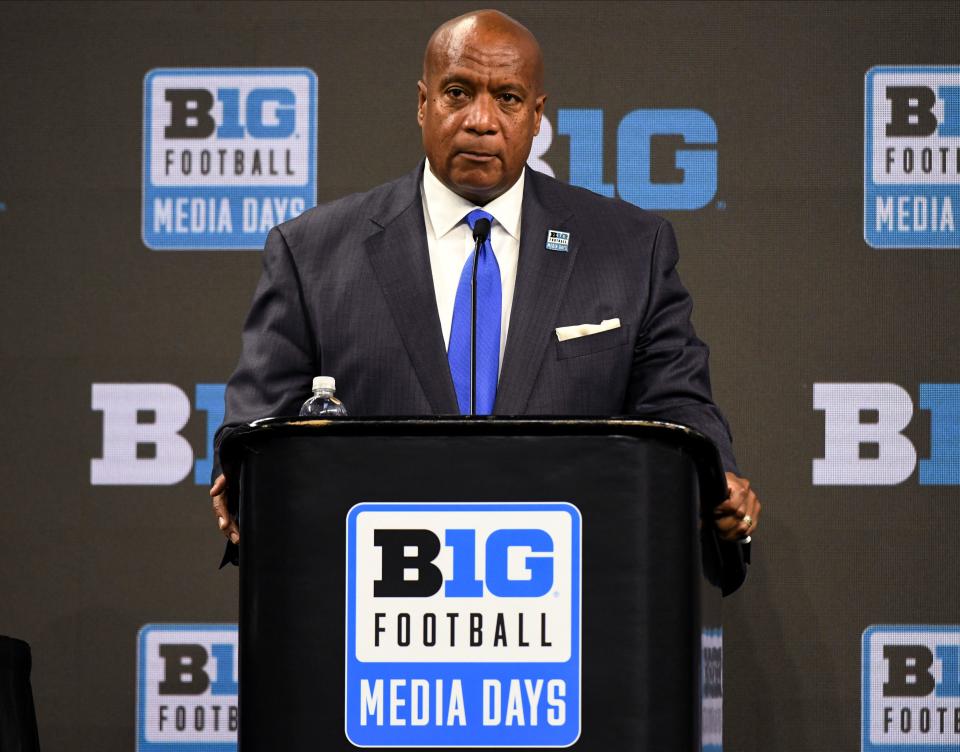

“We are very grateful,” Big Ten Commissioner Kevin Warren said in a statement Thursday, “to our world-class media partners for recognizing the strength of the Big Ten Conference brand and providing the incredible resources we need for our student-athletes to compete at the very highest levels, and to achieve their academic and athletics goals.”

WHAT IT MEANS: The details behind the Big Ten's landmark media rights deal

OPEN RACES: The biggest quarterback competitions that remain undecided

UNFAMILIAR FOES: The 10 best non-conference games for this season

The Big Ten-ESPN divorce was not unexpected. It had been widely reported in recent weeks that the relationship between America’s oldest conference and its most-recognizable sports broadcast provider was almost certainly going to end with this rights package. ESPN and the Big Ten can trace their marriage back to the early 1980s, but as the network drew closer to the SEC and ACC (with whom it operates conference-specific TV channels of their own) and the Big Ten grew stronger, tighter bonds with Fox, the split seemed inevitable.

Thursday still redrew some of the old boundaries in significant ways.

Fox’s long-term relationship with the Big Ten — the network owns 61 percent of BTN, as compared to ESPN’s conference-network arrangements, which are licensing deals — further positioned it to own one of the two most-valuable conference brands in college sports. Big Ten expansion now planting the conference’s flag on both coasts enhanced their joint strength. Fox was even, according to an April report in the Sports Business Journal, essentially advising the Big Ten during its negotiations with other new or expanded partners, meaning Fox could ensure that even within a multi-network arrangement, it remained top dog.

“ESPN is fine. It’s true, and it’s going to stay true. At the same time, Fox is doing quite well,” said Patrick Crakes, a former senior vice president at Fox Sports who now runs his own media consulting company. “In college football, it’s been a duopoly, it stays a duopoly, and Fox has a lot of upside in this.

“It’s definitely Fox and ESPN. ESPN is No. 1, but Fox is No. 2. The way the models are set up, they’re the dominating forces.”

CBS and NBC will still see value.

The former fills its customary Saturday afternoon college football slot (soon to be) previously occupied by the SEC, albeit under different terms. It also expands its college basketball inventory slightly, a win for the conference’s other revenue-generating sport, which otherwise will probably see some growing pains under this new rights deal.

The latter gets both a bigger footprint in college football — a Saturday night Big Ten game to follow the traditional afternoon slot dedicated to Notre Dame — and significant inventory to push to Peacock, its streaming service. As many as 77 Big Ten men’s and women’s basketball games will appear exclusively on Peacock each year, as will eight Big Ten football games.

Despite some flirtation with non-traditional streaming-based partners, specifically Amazon and Apple, the Big Ten kept this deal centered on paid-TV partners. In so doing, it brought all of ESPN’s traditional competitors together in one corner, to sit opposite the Worldwide Leader when it’s time to discuss things like College Football Playoff expansion.

Fox, which got in on the Big Ten’s long-game bet on the future of college sports on television 15 years ago, will lead the way again. Yes, CBS and NBC (particularly NBC) will benefit from this new arrangement. But the Big Ten’s oldest and best friend gets the biggest share of the new pie, and most certainly the catbird’s seat when Playoff expansion goes back on the table.

“Fox has done it in a way that doesn’t build CBS or NBC into a sort of third pillar in college football,” Crakes said. “Fox and ESPN remain the giants. Fox has added new partners for the Big Ten and added a lot of new money for the Big Ten, without really damaging their end.”

This isn’t a proxy war. Fox and ESPN will still generally work in collaboration in many ways.

But they’ll do so much more so as equals than might have been the case 10-12 years ago. Fox, which also benefits from ditching streaming just when seemingly everyone else decided to go all in, more or less stands eye to eye with ESPN these days. If they are not 1a and 1b, they aren’t far from it.

That’s the bet the Big Ten and their Los Angeles-based partner made together more than a decade ago. People wondered if Jim Delany was running down a blind alley then, just as they did when Delany defied convention and limited the current media rights deal to just six years.

It turns out he was setting up his successor, Warren, to land a paradigm-shifting follow-up.

Warren has delivered something resembling his considerable NFL experience, with the Big Ten now coming into homes across three major, recognized networks. He’s changed the measuring stick for what per-year, per-school television rights revenues should look like. He took the Big Ten all the way to the West Coast, and now he’s positioned it alongside the SEC (and its good friend, ESPN) to lead college athletics into an uncertain, fascinating future on any number of issues.

That big bet paid off. From sea to shining sea, Big Ten schools are about to feel the benefit.

This article originally appeared on USA TODAY: Fox, Big Ten big bet on future pays off with $1 billion rights deal

Yahoo Movies

Yahoo Movies