Rainbows and Unicorns: Capital Bancorp, Inc. (NASDAQ:CBNK) Analysts Just Became A Lot More Optimistic

Capital Bancorp, Inc. (NASDAQ:CBNK) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

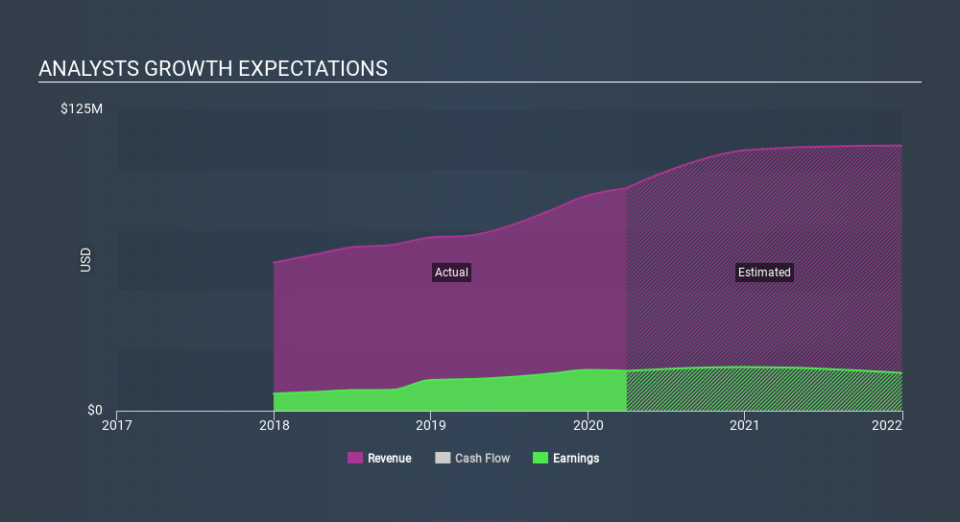

After this upgrade, Capital Bancorp's four analysts are now forecasting revenues of US$108m in 2020. This would be a solid 17% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to rise 7.6% to US$1.29. Before this latest update, the analysts had been forecasting revenues of US$95m and earnings per share (EPS) of US$1.16 in 2020. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Capital Bancorp

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of US$13.00, suggesting that the forecast performance does not have a long term impact on the company's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Capital Bancorp analyst has a price target of US$14.00 per share, while the most pessimistic values it at US$12.00. This is a very narrow spread of estimates, implying either that Capital Bancorp is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Capital Bancorp's revenue growth is expected to slow, with forecast 17% increase next year well below the historical 27% growth over the last year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 2.6% next year. So it's pretty clear that, while Capital Bancorp's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at Capital Bancorp.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential concerns with Capital Bancorp, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 2 other concerns we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Movies

Yahoo Movies