Update: Jazz Pharmaceuticals (NASDAQ:JAZZ) Stock Gained 62% In The Last Year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Over the last year the Jazz Pharmaceuticals plc (NASDAQ:JAZZ) share price is up 62%, but that's less than the broader market return. However, the longer term returns haven't been so impressive, with the stock up just 11% in the last three years.

View our latest analysis for Jazz Pharmaceuticals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Jazz Pharmaceuticals actually shrank its EPS by 53%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 9.3% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

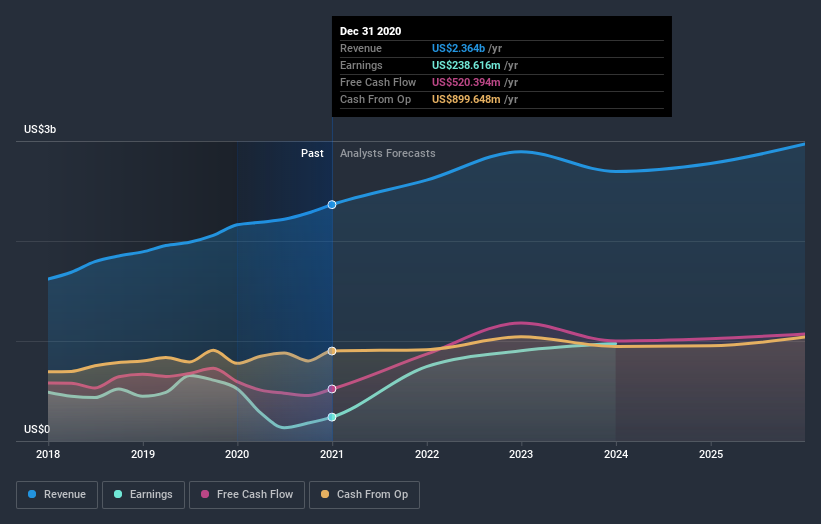

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Jazz Pharmaceuticals in this interactive graph of future profit estimates.

A Different Perspective

Jazz Pharmaceuticals shareholders are up 62% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 4 warning signs we've spotted with Jazz Pharmaceuticals .

Jazz Pharmaceuticals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Movies

Yahoo Movies