Costco Wholesale (NASDAQ:COST) is Thriving in a Challenging Environment for Retailers

This article first appeared on Simply Wall St News.

If retailers had to describe 2021, it would be a hard choice between inflationary pressures, labor shortages, and supply chain issues. Yet, not all retailers are equals, as Costco Wholesale Corporation (NASDAQ: COST) managed to thrive in this tough environment, setting fresh all-time highs.

View our latest analysis for Costco Wholesale

FQ1 Earnings Results

Non-GAAP EPS: US$2.77 (beat by US$0.12)

GAAP EPS: US$2.98 (beat by US$0.33)

Revenue: US$50.36b (beat by US$610m)

Other Highlights

Revenue growth: +16.5% Y/Y

Comparable sales: +9.9% (US) vs consensus estimate +8.3%

E-commerce sales quarterly growth: +9.8%

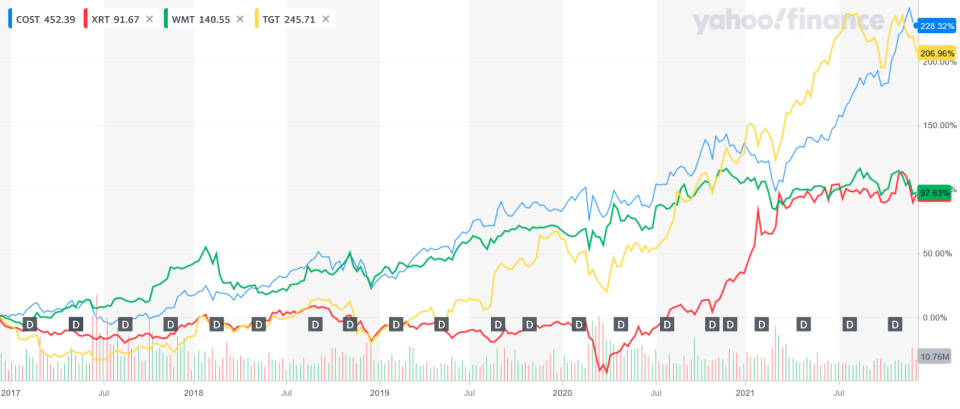

Over the last year, Costco (+17.49%) outperformed the main competitors in Walmart (+4.23%) and Target (+16.62%) in revenue growth. Over the last 5 years, the compounded annual growth rate difference has been significant, with Costco at 10.54%, Target at 7.97%, and Walmart at 3.37%.

This chart best illustrates the difference, benchmarking it against the XRT Retail ETF.

Meanwhile, Berkshire Hathaway's vice-chairman Charlie Munger praised the company for its membership business model that relies on low cost and bulk buying. He believes that Costco's e-commerce business can threaten Amazon. By the valuation, it seems that the market agrees, as the stock currently trades at a 47 P/E ratio – closer to an average tech company than a retailer.

A Look At Superior Returns

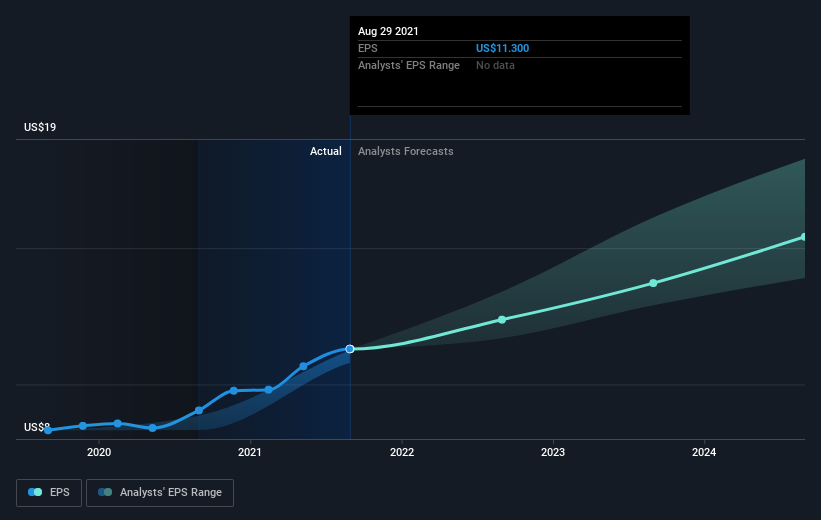

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Costco Wholesale achieved compound earnings per share (EPS) growth of 16% per year. This EPS growth is lower than the 27% average annual increase in the share price. This suggests that market participants hold the company in higher regard. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 46.27.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Costco Wholesale has improved its bottom line lately, but will it grow revenue? Check if analysts think Costco Wholesale will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend.

As it happens, Costco Wholesale's TSR for the last 5 years was 267%, which exceeds the share price return mentioned earlier.

A Different Perspective

Costco Wholesale shareholders have received a total shareholder return of 42% over one year. (including the dividend.) The fact that the company has been doing better recently (even though the above-mentioned sector challenges like inflation, supply chain problems, or labor shortages) is impressive but looks to be priced in.

Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before spending more time on Costco Wholesale, it might be wise to click here to see if insiders have been buying or selling shares.

Are you a shareholder? It seems like the market has already priced in COST’s positive outlook, with shares trading around their fair value. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock? Should the price fluctuate below the true value, will you have enough conviction to buy?

Are you a potential investor? If you’ve been keeping tabs on COST, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the positive outlook is encouraging for the company, which means it’s worth diving deeper into other factors such as the strength of its balance sheet to take advantage of the next price drop.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Movies

Yahoo Movies