Expansion, Recovery and Optimization are the Highlights of Wendy's (NASDAQ:WEN) Earnings Analysis

First published on Simply Wall St News

Sales are expected to grow to 2b in FY 2022, while net income and FCF are recovering, and Wendy's is making more cash than earnings.

Profitability has dropped to 14.5%, but the company is expected to increase returns as the ERP project matures, and sales as it expands into the U.K.

The forward P/E suggests the stock is relatively overvalued, but the business development may justify the premium.

The Wendy's Company's (NASDAQ:WEN) released its Q2 earnings report, and we find that the business is stable, with continuous reinvestment into growth and productivity. While the last six months did mark an increase in some expenses, the company is offsetting that with growth and the planned entry into the U.K. market.

See our latest analysis for Wendy's

Wendy's Q2 Earnings Analysis

Revenue grew 9% YoY to $537.8m

Adj. revenue (total less advertising revenue) grew 10.7% to $432.9m.

Restaurant margins dropped to 14.5% from 20.3%.

Net income dropped by 26.7% to $48.2m

Free cash flow is down 49% on a half-year basis to $95.2m.

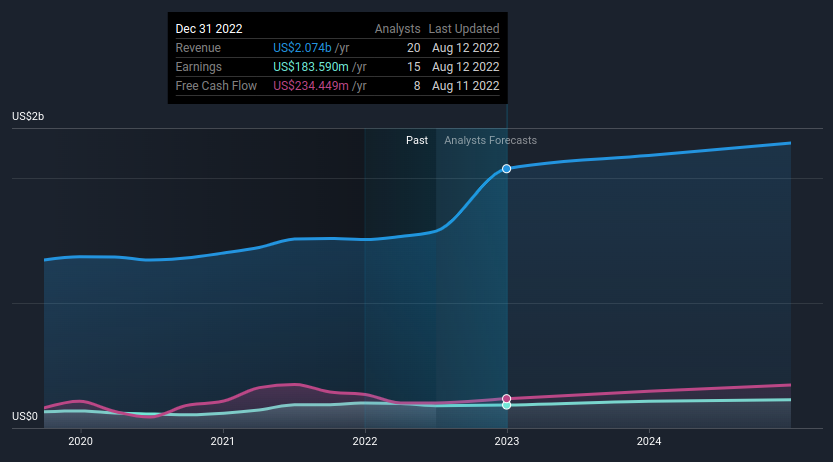

With that in mind, we can also see how analysts are predicting the future of Wendy's in the chart below:

It seems that analysts are expecting Wendy's future revenues to kick off and for the FY 2022, the company is expected to make $2b in sales. The bottom line is also expected to start a recovery, with net income estimated at $184m and free cash flow at $234.5m - both of which are expected to steadily grow through 2025.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wendy's.

This is roughly in-line with the latest 2022 future outlook issued by management:

Global sales growth: 6% to 8%

Cash flows from operations: $305m to $325m

Capital expenditures: $90m to $100m

Free cash flow: $215m to $225m

Adj. EPS: $0.84 to $0.88

Costs Are Rising But Manageable

In the earnings report, we noted an increase in costs (COGS) by 22.9% in the last 6 months, primarily attributable to a decrease in restaurant profitability. The company also noted a general increase in expenses for higher salaries and benefits, it seems that in 2022 Wendy's has indeed suffered the effects of inflation as customers have reduced their spend and costs of running the business have increased.

The earnings report outlined that the company is incurring tech costs due to the implementation of their ERP system. While this is draining profitability at the moment, ERP systems help a company reduce costs and optimize internal operations. This also helps Wendy's better coordinate businesses across countries and legislative compliance, which can help the business with their global expansion - Wendy's opened net 41 restaurants in the first 6 months of 2022 outside the U.S. - Management notes this as the impact of the new locations:

"The increase in revenues was primarily driven by higher sales at Company-operated restaurants driven by the favorable impact of the acquisition of 93 franchise-operated restaurants in Florida during the fourth quarter of 2021 and higher same-restaurant sales, partially offset by the sale of 47 Company-operated restaurants in the New York market."

While the payroll and software expenses from implementing an ERP system count towards operating expenses, some investors may view the complete ERP implementation project as a capital expense, that can increase future value by cutting costs.

What This Means For Investors

At first glance, Wendy's price-to-earnings (or "P/E") ratio of 25.5x might seem on the high end, however EPS is anticipated to climb by 14% per year during the coming three years according to the analysts, which means that there is some future growth holding up the valuation. If we switch to the forward P/E for the company, we see it drop to 23.2x. Additionally, the company has a negative accrual ratio, which means that it makes more cash than is reported by earnings, this is something to consider, as the cash flows may be a more appropriate measure for the company value instead of using a generic P/E ratio.

While the recovering fundamentals are a great aspect of the company, keep in mind that the industry average P/E is at 18.4x, which makes Wendy's relatively overvalued. Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Wendy's you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Movies

Yahoo Movies