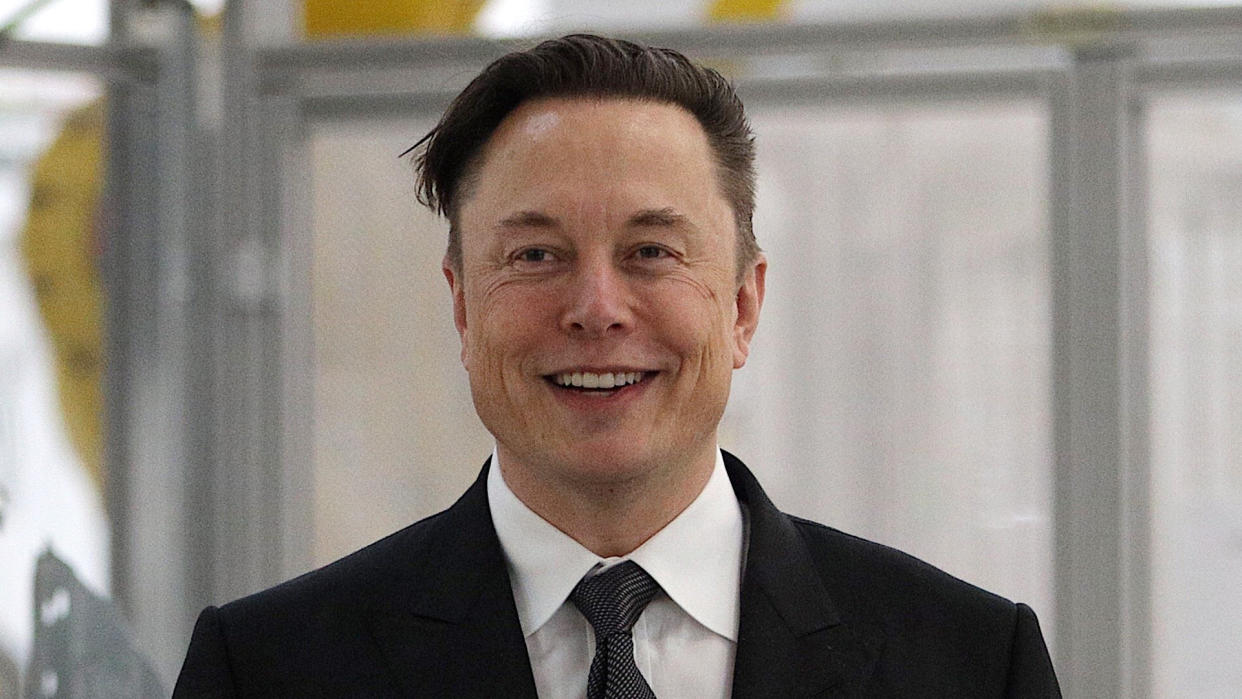

Elon Musk Commits Additional $6.25 Billion for Twitter Deal, Shares Rise

Elon Musk has increased his equity commitment with an additional $6.25 billion for the $44 billion Twitter deal, according to a May 25 Securities and Exchange Commission (SEC) amended filing. The move, which comes amid intense pressure on Tesla’s stock, increases the commitment to $33.5 billion. The filing also notes that Musk is in talks with Jack Dorsey about additional financing.

See: States Whose Economies Are Failing vs. Thriving

Cash App Borrow: How To Borrow Money on Cash App

The previous commitment stood at $27.25 billion. Shares of Twitter, which had dipped over the past month — down 21.1% — were up 5.3% on the morning of May 26.

“The Reporting Person committed to provide an additional $6.25 billion in equity financing to fund a portion of the Merger Consideration by amending and restating the Amended Equity Commitment Letter,” the SEC filing read, in part.

Musk — who has already secured $7.14 billion in funding for his $44 billion Twitter acquisition from a group of investors including Larry Ellison, Sequoia Capital, Binance, Qatar Holdings and many others, as GOBankingRates previously reported — said he may receive additional financing commitments, per the SEC filing.

Indeed, the filing shows that Musk is having discussions with Twitter shareholders, including Jack Dorsey, regarding the possibility of contributing their shares “at or immediately prior to the closing of the merger, in order to retain an equity investment in Parent or Twitter following completion of the Merger in lieu of receiving Merger Consideration in the Merger.”

Related: 6 Alternative Investments To Consider for Diversification in 2022

Dorsey, who stepped down as a Twitter board member on May 25, as GOBankingRates previously reported, holds 2.4% of the social media platform’s shares.

Earlier this month, the richest man on the planet expressed concerns regarding his initial offer, saying that spammers and bots accounted for at least 20% of users on the social media platform — higher than the “less than 5%” Twitter had disclosed in filings.

“I’m worried that Twitter has a disincentive to reduce spam, as it reduces perceived daily users,” Musk also tweeted on May 21. When asked whether Twitter had gotten back to him on the alleged discrepancy, he added: “No, they still refuse to explain how they calculate that 5% of daily users are fake/spam! Very suspicious.”

According to Wedbush Securities analyst Dan Ives, while Musk is committed to the deal, the massive pressure on Tesla’s stock since the deal, a changing stock market/risk environment the last month, and several other financing factors — such as equity financing — have caused Musk to get “cold feet” concerning the Twitter deal. Ives suggests that Musk’s bot concerns are not a new issue, and are likely more of a framing argument to push for a lower price.

Discover: POLL: Have Gas Prices Affected Your Driving Habits?

Live Blog: SNAP (Food Stamps), Social Security Benefits, and More

Ives tweeted on May 26 that “The inverse relationship between Twitter and Tesla remains the brutal and frustrating spiderweb for Tesla investors. Very simply as the Street edges up % chances of a Twitter deal happening (right now 50/50 shot) = Musk needs to come up with $$-ala Tesla stock pressure.”

“Even though this is non-fundamental to Tesla’s story it’s a lingering overhang. Best case scenarios for Tesla stock on Twitter front: 1. Musk walks and pays the $1 billion. 2. Deal price lowered to $42-$45 (less of a burden for Musk). 3. Partners on equity portion including Dorsey/PE,” he added.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Elon Musk Commits Additional $6.25 Billion for Twitter Deal, Shares Rise

Yahoo Movies

Yahoo Movies