DropBox is Our Best Stay at Home Stock - Who Else Benefits?

This article was first published on Simply Wall St News.

We are looking for feedback on this article .

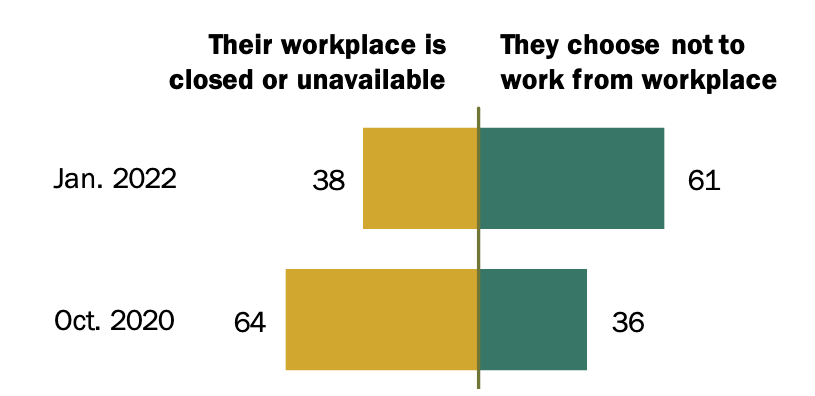

As we begin to shift into a post-COVID world, we can see the beginnings of a revolution in the way we work. Even 2 years on from the outbreak of COVID-19 in the US, data from Pew Research Center suggests that nearly 60% of US workers who have the ability to work from home do so all the time. Compare this to 23% prior to the pandemic, it's clear that people are gravitating towards remote work.

As we move forward and working from home changes from a requirement to an option, we are still expecting a vast quantity of the workforce to elect for a flexible working arrangement. Respondents to the above study have indicated that, of those that have worked from home, 60% say this will continue into the future and a further 78% suggested they’d like to if it was possible.

From these figures we can see that the pandemic was a catalyst for a fundamental change in our approach to work. Many brick and mortar businesses will suffer as a result, however some businesses are set to prosper from this revolution.

the time , % saying they are doing so because...

( Source : Survey of U.S. adults conducted Jan. 24 - 30, 2022.

“ COVID - 19 Pandemic Continues T o Reshape Work in America ”, Pew Research Center)

DropBox (NASDAQ:DBX)

DropBox’s name is synonymous with file-sharing, however in recent years the business has grown to include a range of product offerings to provide value to companies with a distributed workforce. With over 17M paying users - 80% of whom use DropBox for work related purposes - it was imperative that the company align themselves with a changing environment. By adding HelloSign and DropBox DocSend to their product portfolio, DropBox are looking to expand their use-case and provide a more holistic product suite for commercial customers.

Even prior to the pandemic, DropBox had a stranglehold on the cloud storage sector, but the need for large-scale file sharing was exacerbated when file-sharing and collaboration became impossible through traditional means. The proof is in the pudding for DropBox with strong performances across the board in their financials and a noteworthy gain in the number of paying users from 14.31M in 2019 to 16.79M by the end of 2021; illustrating that their strength lies in catering to hybrid working.

Moving forward, DropBox will look to grow their presence in the workplace. We see these developments as a foundation for success in a ‘virtual first’ working world:

New products catering towards distributed teams. DropBox’s newly implemented Capture, Replay and Shop products all provide users with the ability to share, provide feedback and collaborate on work asynchronously. With 35% of paying users on team plans, it’s important for DropBox to meet the needs of these businesses as it provides opportunities to grow revenue as these businesses expand.

Integration with other cloud-based platforms. DropBox has partnered with software giants like Google, Microsoft, Zoom, Atlassian, and Salesforce in strategic partnerships to expand their customer base and get product exposure. Aligning their product with other channels that accommodate distributed work will mean that they should see continued growth as working life evolves.

On the other hand, our analysis of DropBox’s financial health has raised some questions. We encourage you to check out our company report on DropBox to see if these factors are going to impact the company’s performance.

DocuSign (NASDAQ:DOCU)

DocuSign is a pioneer in eSignature solutions for businesses, offering a market leading experience in sending and signing documents electronically. With organizations like Apple, Samsung, BMW and Salesforce utilizing their products, there’s a strong possibility you’ve used DocuSign without even knowing it.

DocuSign has not only survived, but thrived throughout the pandemic as it helps to completely digitize a workflow that is used by many different businesses. With applications ranging from Loan documents, NDAs, Software License Agreements, DocuSign has helped modernize one of the last remaining facets of business that required manual processing, allowing agreements to be completed faster, more cost effectively and more securely. Throughout the brunt of the pandemic, when much of the workforce was absent from the office, DocuSign illustrated its true strength, growing its customer base rapidly from 477,000 in FY2019 to 1,170,000 in FY2022. Financially, the company continued the trend, seeing year-on-year revenue growth hit 45% for FY2022.

By allowing its customers to take this agreement processing workflow remotely, they’ve ensured ongoing relevance in a future characterized by distributed work. We see a bright future for DocuSign in the following ways:

eSignature integration leading the market. DocuSign’s eSignature has been integrated into over 400 applications most commonly used by businesses across a number of sectors. Helping a wide range of industries that aren’t congruent to remote work to function efficiently when they would otherwise experience disruption.

Launch of Contract Lifecycle Management product and integrated products. Through recent acquisitions, DocuSign has expanded its product offering to include a Contract Lifecycle Management software which allows for businesses to generate and track agreements from a centralized repository. This has helped drive growth in enterprise customers seeking a cloud-based solution that can be utilized and accessed from anywhere.

DocuSign scores 5 out of 6 on our analysis of its future growth but that doesn’t mean this stock is without risk. An overview on the risks we’ve identified for DocuSign are available for free on our company report .

Zoom Video Communications Inc (NASDAQ:ZM)

Zoom is a leading communication platform offering market leading remote meeting, webinar and event solutions. Since the beginning of the pandemic, Zoom’s name has become synonymous with remote work as it became the primary communication platform for work and education. Allowing a relatively seamless transition from face-to-face meetings to ones hosted from the comfort of your own home, Zoom really hit its stride in the aftermath of the pandemic.

As education returns to the classroom and some of the workforce returns to the office, it’s imperative that Zoom positions itself well to ensure continuing relevance and that its initial success wasn’t just a flash in the pan. Ongoing success relies on a stable customer base and so Zoom’s Enterprise customers remain a key group to target, owing to their high retention rates and extensive upsell opportunities. It’s impressive to see Zoom’s Enterprise customers reach 191,000 in Q4 FY22, up from 141,100 in Q4 of FY21.

Zoom experienced a meteoric rise at the beginning of the pandemic but as we return to a sense of normality, it’ll need to remain diligent to ensure it remains relevant. Here is where we see Zoom preparing for the future:

Release of Zoom Apps to support remote working. Zoom Apps allows developers to augment the existing functionality by building apps to meet their workflow needs. This gives Zoom a ‘one size fits all’ advantage where business customers won’t need to look elsewhere to find a product that meets a specific need of their workforce if they continue to work from home.

Zoom Whiteboard. Released in 2022, Zoom's Whiteboard is their answer to the shortcomings of remote meetings. Seeking to provide a unified space for brainstorming and collaboration, bridging the gap between remote and on-site working.

Zoom is set to enjoy consistently growing revenues for the next few years but analysts are forecasting that earnings will fall over the next three years. You can keep an eye on Zoom’s future earnings by heading to our Simply Wall St Zoom analysis .

Chewy Inc. (NYSE:CHWY)

The time away from the office has had some huge benefits for companies that investors may not have foreseen. Working from home grants us a greater work-life balance. More time to spend on our many hobbies, more time to spend with our family and - in this case - more time to commit to our furry friends. Chewy Inc is an online retailer for pet products which saw its business boom during the last few years. Chewy’s online business offers convenience to households who are finding themselves home-bound by providing fast delivery on any pet-related item you may need.

Given the spending profiles of households changed with the change in work setting, consumers were more inclined to treat their pets to Chewy’s offerings and the company saw net sales increase 24% year on year in FY2021. Importantly, Chewy’s net sales per customer reached an all time high of $430 during this period, a good indication that pet owners are gravitating towards an online shopping experience

Here’s are some of the opportunities that Chewy is exploring to ensure their continued leadership in the online retail market for pet products:

‘Petscriptions’ portal providing convenient alternatives to a trip to the vet. Chewy has expanded its product offerings to include a pet pharmacy where customers can place an order online for prescription medicine for their pet. Orders will be placed and prescriptions will be sent electronically to partnered vets for approval. Once approved the customers will receive the medication without having to take time off work or leave the side of their pet in need.

AutoShip subscription gives people the option to set-and-forget to focus on their work. When working remotely, dropping by the pet store on the way from home is no longer an option. Through Chewy’s Autoship, customers are now able to set up recurring deliveries for the essential pet items so that their transition from working to leisure does not have to involve a dreaded trip to the store. By shifting the purchasing experience to effectively a subscription based model, Chewy is able to retain more active customers.

Shareholders have been feeling the pain, with Chewy’s share price dropping nearly 39% over the last 30 days, but the future does look a little brighter for them. Check out why Chewy scores 5 out of 6 in our analysis of future growth in our company report.

Salesforce (NYSE:CRM)

Salesforce is the leading provider of cloud-based customer relationship management (CRM) software solutions. Offering an all encompassing package with their flagship Customer 360 product, Salesforce aims to connect sales, marketing, IT and analytics teams on one platform.

Offering a cloud-based solution has helped accelerate the company’s growth during the pandemic as businesses search for a way to allow divisions to interact when working remotely.

By creating a product that is targeted towards a distributed workforce, Salesforce is able to capitalize on an influx of companies that are giving employees greater flexibility on how and where they want to work. Salesforce has seen a 40% compounded annual growth rate in the number of enterprise customers generating ARR of $10M+. Larger enterprise customers like these are less likely to change platforms owing to the scale of their operations and so gaining more of them is a sign that Salesforce will remain in a strong position in the market.

Here is why we see that Salesforce is able to capitalize on the new normal:

Acquisition of Slack Technologies. In July 2021, Salesforce completed its largest acquisition to date, acquiring the collaborative messaging app Slack in a $27.7B deal. The deal should provide significant benefits in a remote working environment as it allows Salesforce to provide a simplified solution to business management and communication.

A look in Salesforce reveals that company insiders own 3.3% of the company but are selling down their holdings. If you’ve got your eye on Salesforce, we welcome you to check out our breakdown of the company’s ownership .What’s Next for these companies?

Steelcase Inc (NYSE:SCS)

We are beginning to see a rise in the idea of hybrid work, which is founded on the basis that office spaces are still relevant for innovation, work culture and collaboration but the flexibility of working from home some days will provide the necessary work-life balance employees need. Primarily operating in the corporate, educational and medical markets, Steelcase - the world’s largest office furniture manufacturer - has seen major disruption to their core business as these workplaces lay empty. Despite this, there are looming opportunities for Steelcase to capitalize should they read the market well.

The Harvard Business Review expects only a 1% reduction in the amount of office space used by firms, even though the anticipated reduction in the on-site days for workers offered the flexibility to work from home is as high as 30%. This insight reveals that office spaces aren’t going away but the way we use them is undergoing a fundamental shift.

Here is where we see Steelcase can benefit by reacting to this:

Hybrid work provides growth opportunities. Workers dividing their time between the office and home provides an opportunity to service enterprise and individual consumers simultaneously. Should more workers switch to working from home part-time, Steelcase is presented with a valuable growing market for people requiring high quality office furniture. Increasing their presence in the individual consumer space.

Opportunities in the new way we approach office work. Working from home has made it clear to many workers that privacy is important to us. Even in firms that require a lot of collaboration, we have found that a separate space can help focus and productivity. Steelcase is exploring this idea by building new product lines to offer on-site workers greater privacy when they need it.

Analysts are expecting Steelcase to outpace the market in future earnings growth by a significant margin but lag behind the market for revenue growth. To learn more about Steelcase’s outlook for future earnings, head over to our analysis on Steelcase’s company report .

What’s Next for these companies?

Thanks to an unprecedented shift in the way we work, each of these companies have found the opportunity for growth. Many of these companies were beneficiaries of the sudden response to the COVID pandemic, growing much faster than they could’ve ever done organically. However, such rapid growth places them at risk of failing to adapt once the tailwinds of a disrupted working environment die down. If you're an investor that prefers to shy away from this risk, we encourage you to check out our list of Top US Dividend Stocks .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Movies

Yahoo Movies