Cybersecurity automation firm Torq lands $42M in expanded Series B

Torq, a self-described "hyperautomation" cybersecurity startup, today announced that it raised $42 million in an extension to its Series B funding round from investors, including Bessemer Venture Partners, GGV Capital, Insight Partners, Greenfield Partners and Evolution Equity Partners.

Bringing the company's total raised to $120 million, the new cash will be put toward expanding Torq's platform, including with AI capabilities; international growth; and increasing Torq's sales channel presence, co-founder and CEO Ofer Smadari says.

"Making enterprise security an enabler rather than a blocker for digital innovation is the single biggest challenge facing everyone in the industry," Smadari told TechCrunch in an email interview. "Torq’s approach to a hyperautomation platform works across multiple pillars of the organizational cybersecurity platform, making the organization more resilient."

Smadari co-founded Portland, Oregon–based Torq alongside Leonid Belkind and Eldad Livni in 2020. Smadari previously co-launched Luminate, a zero trust platform acquired by Symantec in 2019, and spent several years in executive roles at cybersecurity startups Adallom and FireLayers. Belkind and Livni were at Check Point, building and shipping network security products, prior to joining Torq.

So, you might be wondering -- as was this writer, frankly -- what's hyperautomation? So far as I can tell, hyperautomation refers to automating across every process and tool in an organization -- not simply parts or individual pieces of processes and tools.

To that end, Torq lets IT teams create and deploy security workflows designed to integrate with existing cybersecurity infrastructure. The company offers a service that leverages generative AI -- specifically large language models (LLMs) along the lines of OpenAI's ChatGPT -- to analyze, "comprehend" and answer questions about SOC playbooks, the step-by-step guides in an organization that help security analysts navigate security incidents.

There's a lot of enthusiasm for AI and automation among the enterprise, particularly where it pertains to security. Recently, both Google and Microsoft launched GenAI tools aimed at summarizing and making sense of threat intelligence, while startups like Nexusflow are building AI-powered conversational interfaces for security tools.

So what sets Torq apart? Embracing cutting-edge models, Smadari claims.

"Quick adoption of recently-announced newer generations of . . . leading LLMs such as [OpenAI's] GPT-4 and [Google's] Gemini enabled Torq’s AI services to make a huge leap in terms of performance," he added. "The latest innovations in core LLM optimization allows Torq to perform meaningful analysis of greater amounts of security signals while keeping the 'cost of investigation' under strict control."

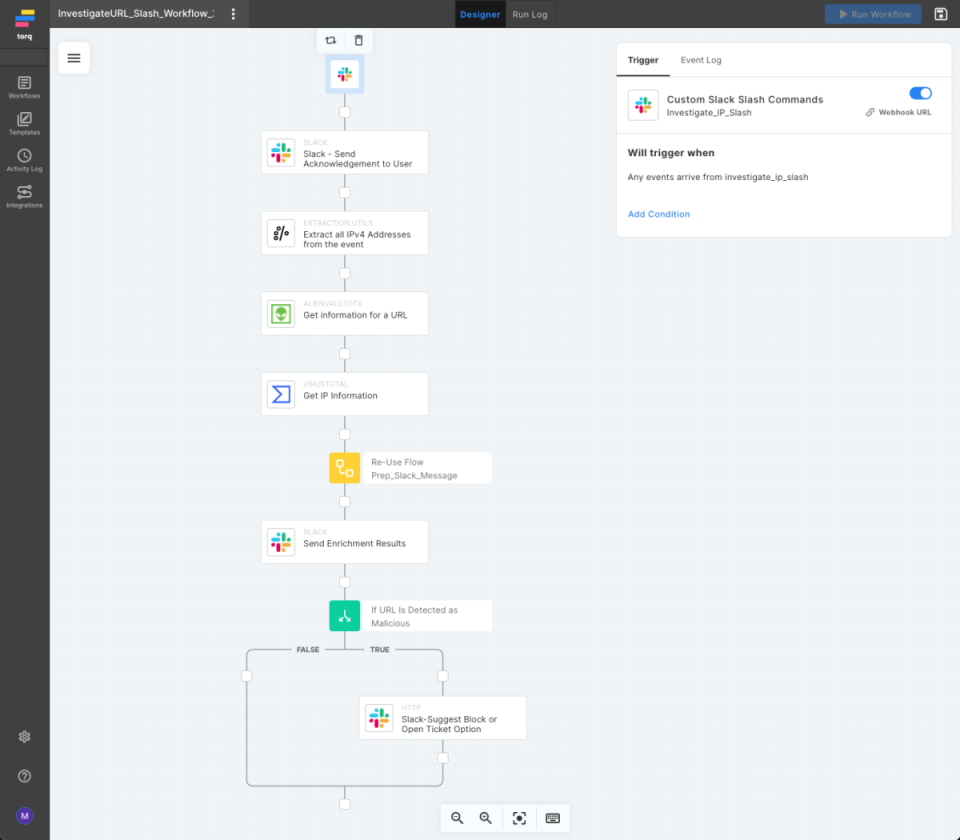

Torq's automation platform for security. Image Credits: Torq

Now, letting third-party models analyze sensitive security data might set off alarm bells at some organizations -- especially those in highly regulated industries. Motivated by related fears, some companies have gone so far as to ban GenAI tools like ChatGPT in their workplace.

Smadari asserts, however, that Torq gives customers the ability to choose which parts of their data are accessible to the Torq platform and where that data's stored -- e.g. on storage operated by Torq or on company-owned and managed storage.

"Our privacy and data architecture, as well as usage and protection policies, are very strict," he said.

It's a sales pitch that's resonating, evidently. Torq hasn't had trouble attracting customers.

According to Smadari, Torq, which makes money by charging an annual subscription, has grown revenue 300% in 2023 on 500% client base growth. Today, Torq has around 100 enterprise customers, including big-name brands like Blackstone, Chipotle, Rivian, Lemonade and Fiverr.

Torq's expansion is all the more impressive considering the rather depressing state of cybersecurity funding. Going by Crunchbase data, investors are pouring 50% less money into cybersecurity startups compared to 2022, and cybersecurity financing has hit a five-year low.

"From its inception, Torq has had responsible growth as one of its main culture pillars," Smadari said. "We've exercised tight control over our investments, and very close alignment of these with income sources has allowed us to avoid the traditional pitfall many other companies have fallen into -- overgrowth during times of 'hype.'"

It probably helps that interest for security automation remains high.

Per a 2023 poll from security analytics firm Devo, 80% of security leaders predict an increase in cybersecurity automation in the coming year -- citing the potential for enhanced incident analysis, faster threat detection and response and more thorough, wider-scope analyses of apps and data sources.

"Visibility of where the organization is at any given moment in its transformation from old school-, manual operations-centric approaches to the modern, engineering-centric hyperautomation -- as well as advisory and guidance on setting the proper targets and KPIs for the 'journey' -- is where Torq meets the C-suite-level managers in the organization," Smadari said. "Torq provides meaningful strategies that are closely aligned with the business goals of the respective company."

To stay ahead of rivals like Fortinet, Tines and Swimlane, Torq recently rolled out a partner program for managed detection and response providers and a separate partner program, the Torq Partner Acceleration Program, for general resellers.

After making several executive team hires toward the end of 2023, including a chief marketing officer and head of global channels and alliances, Torq intends to grow its 150-employee workforce by 30% by the end of 2024. That's on top of a 25% increase in headcount from early last year to now -- an aggressive expansion to be sure.

Yahoo Movies

Yahoo Movies