CLS Holdings (LON:CLI) shareholders have endured a 14% loss from investing in the stock a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the CLS Holdings plc (LON:CLI) share price is down 17% in the last year. That contrasts poorly with the market decline of 6.1%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 7.1% in three years. More recently, the share price has dropped a further 9.2% in a month. We do note, however, that the broader market is down 5.7% in that period, and this may have weighed on the share price.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for CLS Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the CLS Holdings share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

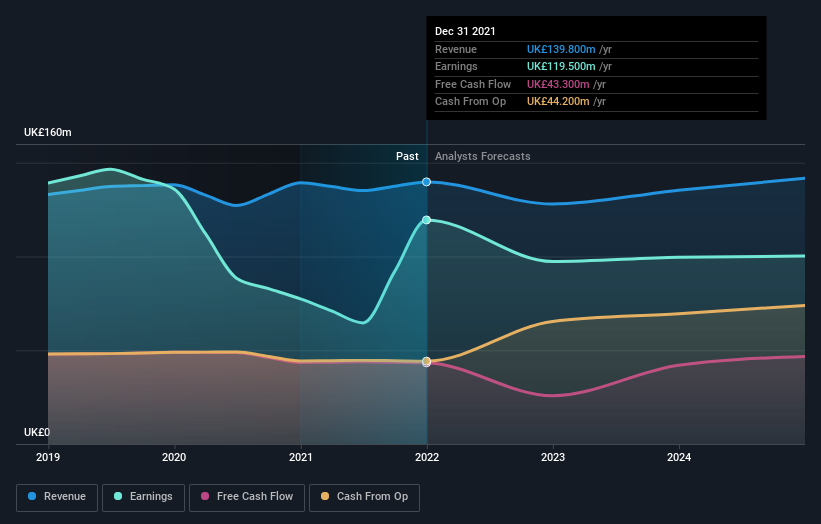

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for CLS Holdings in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of CLS Holdings, it has a TSR of -14% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 6.1% in the twelve months, CLS Holdings shareholders did even worse, losing 14% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - CLS Holdings has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

CLS Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Movies

Yahoo Movies