Biden’s fly-by-the-seat-of-his-pants approach to canceling student loans is creating a huge mess

There’s a reason why presidents aren’t supposed to have the power to snap their fingers and fashion new programs that cost Americans hundreds of billions of dollars.

Look no further than the Biden administration’s “plan” to wipe out up to $20,000 of debt for student loan borrowers who meet lenient income caps.

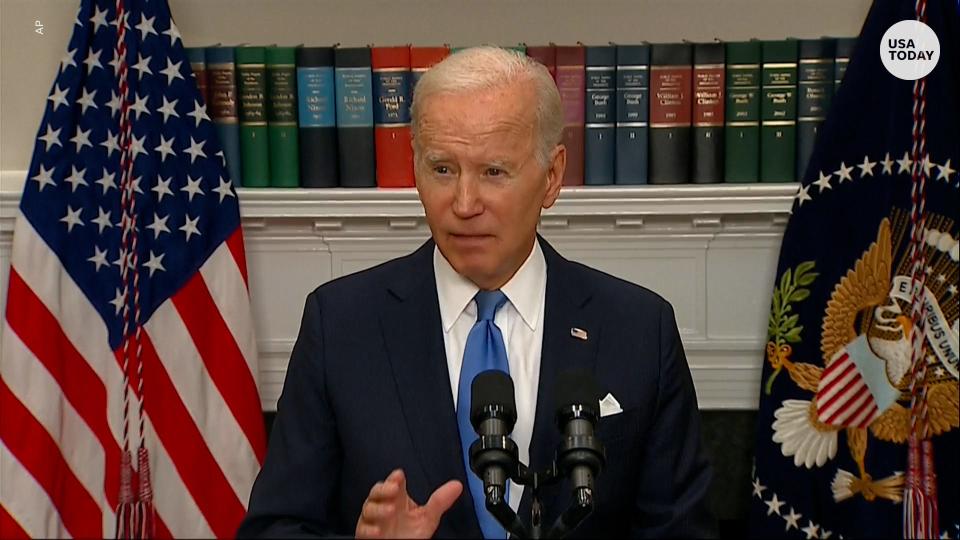

President Joe Biden announced the giveaway in late August, without bothering to go through Congress or even the traditional notice and comment process for department rulemaking.

Nah. He just did it all by himself.

And there’s lots that borrowers still don’t know about how or whether to apply and when those applications will be ready.

Lawsuits highlight flaws in blanket forgiveness

Last week, several lawsuits challenged the administration’s illegal maneuvering.

I wrote about the first lawsuit from the Pacific Legal Foundation, which is suing on behalf of a borrower who would have been financially harmed from the loan forgiveness plan. He lives in a state that taxes this kind of student loan cancellation.

More from Ingrid Jacques: First lawsuit is filed challenging Biden's costly, unfair student loan forgiveness plan

And because of his participation in another federal loan program for public service workers, the government had initially said his debt would be canceled automatically, and there was no way for him to opt out.

Guess what? Shortly after the lawsuit was filed, the Biden administration “fine-tuned” the wording so that the thousands of borrowers in the plaintiff’s situation could opt out. But it’s still unclear when the cancellation will take place and how that opt-out process is going to work.

“It’s a complete reversal,” said Larry Salzman, director of litigation at the Pacific Legal Foundation (PLF).

In response to Biden’s shifting language, a judge denied PLF’s request for a temporary restraining order, without prejudice. But the court is giving the group time to amend its complaint and to add new plaintiffs.

In a another lawsuit filed last week, six states – Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina – sued the administration because its loan plan will cost their states revenue. A former program had allowed private banks to issue federally backed student loans, and the administration had initially said these loans would also qualify for forgiveness.

High school teacher: My students struggle to pay for college. Student loan forgiveness doesn't fix the system.

After the lawsuit, however, the Education Department quietly updated its website on Thursday, saying that borrowers with loans through the Federal Family Education Loan program or Perkins loans no longer qualify. That affects about 770,000 borrowers.

No, Mr. President, PPP loans are nothing like student loans

Biden has taken to comparing his student loan cancellation plan to the Paycheck Protection Program, which offered relief to small businesses during the peak of COVID-19. The government gave loans to businesses with the intent that the loans would be forgiven if the funding was used as intended.

The president is doing this in an attempt to smear Republicans he doesn’t like, because some of them benefitted from the business loans. But these two types of relief are nothing alike.

While there is no doubt that there’s waste (and probably fraud) in the PPP – this happens anytime Congress pushes through huge sums of money without much debate – at least the program went through Congress.

Biden has skirted the legislative branch altogether with his loan forgiveness.

Opinion alerts: Get columns from your favorite columnists + expert analysis on top issues, delivered straight to your device through the USA TODAY app. Don't have the app? Download it for free from your app store.

And the PPP was created to help keep as many jobs intact as possible during a pandemic, when state governments around the country forced many businesses to close. This is a very different situation from the millions of people who have voluntarily taken out loans – without the expectation of forgiveness – to attend college (often expensive colleges).

There’s much that’s wrong with Biden’s loan forgiveness, but seeking to undercut these lawsuits by backtracking on the administration’s own language seems a brazen attempt to avoid closer judicial review of a program that lacks legal standing.

Expect the lawsuits and the confusion to continue.

“This shows the dangers of acting unilaterally without congressional authorization,” the Pacific Legal Foundation's Salzman said.

Ingrid Jacques is a columnist at USA TODAY. Contact her at ijacques@usatoday.com or on Twitter: @Ingrid_Jacques

More from Ingrid Jacques:

Dumping Roe v. Wade may backfire on abortion opponents. Republicans should have been ready.

If pandemic is 'over,' president should follow through and end national 'emergency'

You can read diverse opinions from our Board of Contributors and other writers on the Opinion front page, on Twitter @usatodayopinion and in our daily Opinion newsletter. To respond to a column, submit a comment to letters@usatoday.com.

This article originally appeared on USA TODAY: Biden's student loan forgiveness reversal: Lawsuit shows plan's flaws

Yahoo Movies

Yahoo Movies