America's aching economy is forcing tough choices. How people are 'barely making it' work.

A dollar doesn't go as far as it used to.

Americans are paying higher prices for everything from groceries to gas. The consumer price index, which measures what consumers spend on goods and services, rose 8.3% in August from a year ago.

With wages lagging surging inflation, household budgets are being stretched thinner than a rubber band. More than one-third of Americans said it was somewhat or very difficult to pay for household expenses, according to a recent U.S. Census Bureau survey.

Savings are dwindling and credit card debt is mounting. To get by, people are cutting back on meat for dinner and on nights out. Even kids are going without new shoes or supplies for school.

USA TODAY talked with families from California to Georgia and from Arkansas to Ohio about how they are coping with their new economic reality. These are the faces of inflation.

A lose-lose situation: Many Americans find themselves in a Catch-22 as inflation keeps prices, interest rates high

'Barely making it:' Struggling with rent hikes in Atlanta

When Sonja Smith retired from her job as a Georgia state government employee in 2018, she planned to volunteer and work part-time as an insurance agent.

Last year, Smith, 55, was forced out of retirement when she could no longer pay her bills.

“I thought my pension would be enough,” she said, especially since she’d moved out of a market-rate apartment in a nice neighborhood to low-income “tax credit” housing in a not-so-safe part of town.

Smith’s top priority was to stay in the city of Atlanta so her 15-year-old daughter could continue to attend the city charter school.

But thanks to record high inflation, her rent increased from $950 per month in 2019 to $1,113 in 2020. The cost of food, gas and auto insurance also jumped. Her auto insurance went from $200 a month to $300 a month since she was living in a “high crime” area, she says.

Coping with inflation

The USA TODAY Money team wants to hear from you. How has inflation impacted you? What changes have you made to cope?

Rent hike pain: Rents are rising at fastest pace in 40 years. Why it's bad for inflation, the Fed, and you.

Smith gets about $2,300 per month in pension.

“We ate a lot of salads and beans because I just couldn't afford the meat,” she says.

Last year, she went back to work full-time.

Smith is a human resource specialist with the Clayton County School District and makes about $42,000 a year. This year, she received a pay raise of 3%.

Last year, differences in year-over-year wage growth rates between private sector and state and local government doubled to the highest levels in nearly four decades, according to Pew Research.

“Our pay increases have not kept up with inflation and it is hurting us,” says Smith. “That’s why we are having teacher shortages. It’s the wages.”

Middle income pain: How inflation's wrath, recession fears are heading into middle, upper, class America

When she reported her additional income, her rent increased to the market rate rent – $1,450. Her current lease ends in December and she's worried her new rent could jump up to $1,650.

"That's the going market rate," she says.

She briefly considered moving back to her old neighborhood in hopes of saving on auto insurance. But the sticker shock stopped her: The rent there now is $1,900. Now, between her pension and her new job, she makes about the same amount as her previous full-time job.

“I’m barely making it,” she says.

— Swapna Venugopal Ramaswamy

'It all adds up' for Ohio farmer to get food from the farm to tables

Chuck Dilbone, 70, a retired high school principal and business manager, has the kind of hardiness that comes from 13 years of planting and harvesting crops. The soil is so deep under his fingernails, it doesn’t wash off.

He and his wife Cynthia, 68, a retired elementary school teacher, run Sunbeam Family Farm, a small organic spread in Alexandria, Ohio.

Chuck Dilbone has never needed his experience running a big high school budget more than when forecasting the year ahead.

“We budget conservatively in case of a crop failure and we make sure we stay within our budget and so forth,” Dilbone said. “This year everything we buy has increased.”

He buys most of what the farm needs in January when it gets discounts from suppliers. Recently when he picked up some additional potting soil and fertilizer, prices had gone up almost 10%.

Everything else has gotten worryingly higher, too: Crop seeds, fertilizer, irrigation supplies, fabric, hoops and sandbags to protect the plants because the farm does not use chemicals and insecticides, even gasoline for the mower.

Feeling the pinch: Farmers face higher stakes than ever with inflation.

“All of those things add up,” Dilbone said.

He doesn’t want to pass along higher costs to customers – his neighbors – who are struggling with rapidly rising prices, too. So Sunbeam Farm has only gingerly increased the price of kale, swiss chard and collard greens.

“It has been tight,” Dilbone said. “You have to watch that bottom line very carefully.”

But he says he’s not too concerned. “Being my age, we have been through this before,” Dilbone said. “I have faith in our country, I have faith in our leaders and I have faith in our people. I believe it will recycle back again. But it’s painful for the time being.”

– Jessica Guynn

'It's no longer an American dream' for Arkansas family

Deysi Garcia says she immigrated to the United States from Mexico in 2004 to live the American dream. But the highest inflation in 40 years is forcing her family to make hard choices. Nearly all of their money goes to basic necessities.

"It’s a big difference for immigrants, and other people, because it’s no longer an American dream, it’s survival," she said.

Garcia, 38, lives with her husband, Adalberto Toledo, and four children in a two-bedroom house they own in Jonesboro, Arkansas.

She used to work as a housekeeper but now her family scrapes by on Toledo’s paycheck in construction while she stays home to care for their 1½-year-old who requires therapy.

In fair weather, Toledo works five to six days a week as a roofer and brings home as much as $800 a week. But from November to February, work dries up and his paycheck shrinks.

More often than not, they spend more than Toledo brings home. So Garcia has to sit down and make a tough calculation each month, which bills will get paid and which ones will have to wait.

One of her biggest bills is electricity and water, which runs $370 to $380 a month, Garcia says. Utility costs have spiked as costs for electricity in the U.S. climbed at their fastest rate in 40 years, according to the consumer price index.

"I don’t have that opportunity to buy anything I might need around the house because I have to think about milk, food, what we’re eating today, what we’re eating tomorrow, gas for the car," Garcia said.

The more prices rise, the more she worries.

“All we get are bills and bills and bills. The only thing they don’t charge us for is to receive the bills in the mail,” she said. “Honestly, I don’t think things will get better. Throughout the year, things have just gotten worse.”

– Jessica Guynn and Josh Rivera

Groceries on a tight budget: Clipping coupons in San Antonio, Texas

During the last big recession, Jennifer King and her wife Heather McVea had to survive on one income.

With just $35 for groceries each week, King would pull out a thick stack of paper coupons at the register, ignoring the occasional side eye from the shopper behind her.

She got so clever at saving money, she started a couponing blog. She calls it her “accidental career.”

Eating costs more: Food prices soar amid inflation. How much the cost of eggs, cereal, milk is going up.

Now, with groceries up 15% year-over-year in San Antonio, Texas, King, 47, is tracking rising prices the way many people check the weather.

Locally a carton of eggs that used to be $6 is now $11.59. “It’s literally doubled,” she said. “That is some serious sticker shock.”

So she buys eggs less frequently and chooses other sources of protein, such as breakfast tacos with bean and cheese rather than bacon and eggs.

Same thing with milk. A gallon of nonorganic skim milk used to be $2.88, now it's about $3.50. So she and her wife have cut back on drinking milk or scout for promotions.

Saving money has gotten trickier. Prices have been ticking up since last year while savings have been vanishing with fewer coupons and rebates.

So King has doubled down. She makes a list and sticks to it. She shops online so she can maximize savings and only after dinner when she’s not hungry. She opts for curbside pick-up or delivery to cut down on impulse purchases.

SUBSCRIBE: Help support quality journalism like this.

With prices rising on every household item, she is not brand loyal. She swapped name-brand laundry pods, which cost as much as 45 cents a load, for eco-friendly laundry sheets that cost 7 cents a load.

The savings are nothing to sniff at. One of her couponing apps keeps a running tally: $11,500 over the past 10 years. “That’s still a grand a year,” she said. “That’s a significant amount of breathing room in a household budget.”

That breathing room has meant she and her wife can keep socking away money for retirement and travel to Baltimore to visit King’s family, even when times get tight.

They can also donate shelf-stable food to the local pantry at St. Luke's Episcopal Church, something King loves to do in memory of her mom who attended services there when she visited. King recently scooped up a deal at Kroger for General Mills cereal: five boxes for $7.

– Jessica Guynn

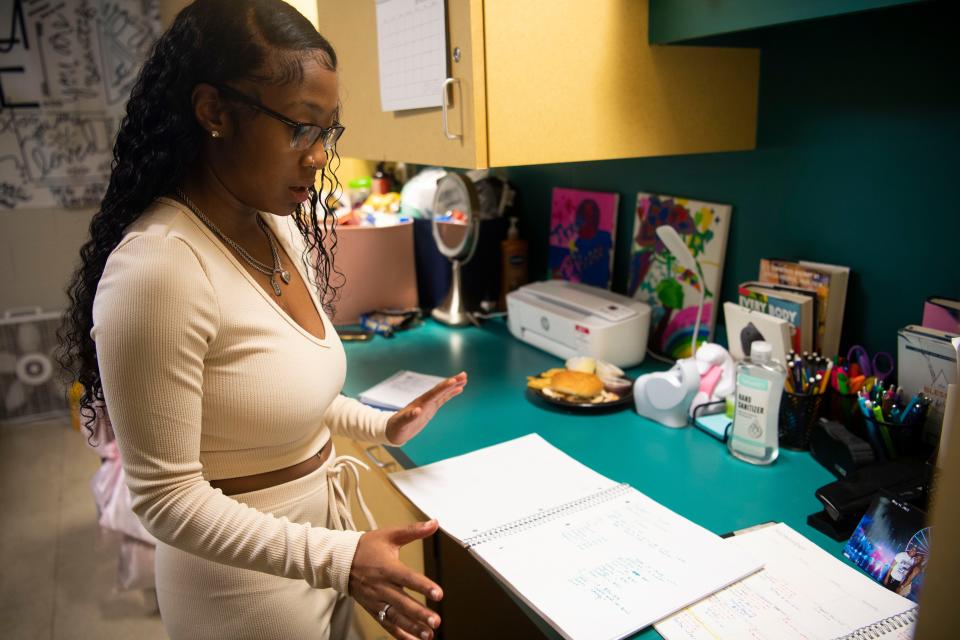

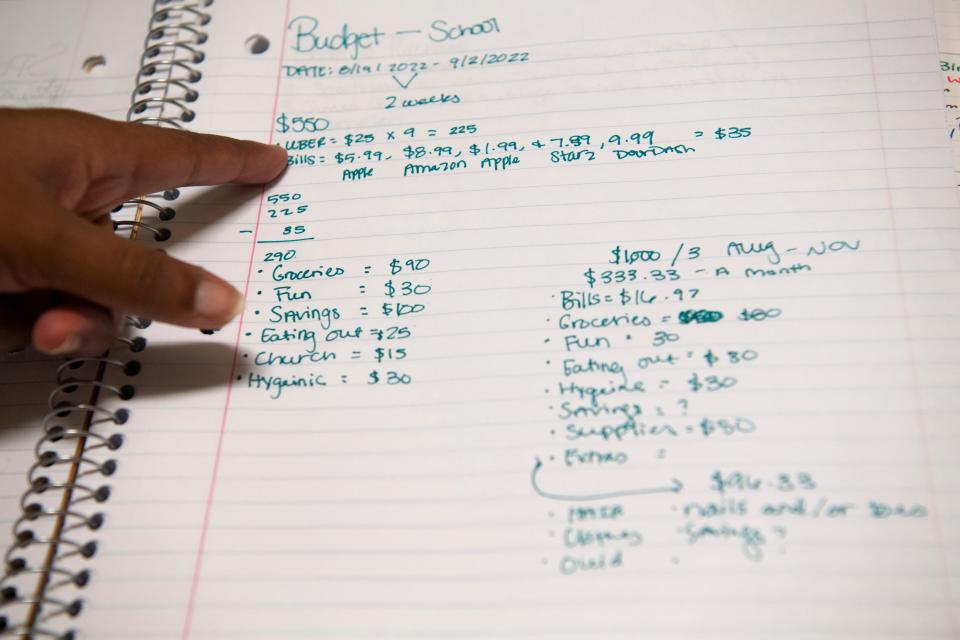

'I'm paying for that gas': First-generation college student works to stay in school

It was hard enough for Aaliyah Riddle, 20, to make it to college as a first-generation student. But inflation has made staying in college at Fisk University, a historically Black university in Nashville, Tennessee, even more difficult, despite the full scholarship that covers room and board.

And come Oct. 7, she faces unemployment.

Riddle, a junior majoring in psychology, earns $16 an hour working as a part-time technician at a plasma donation center. The center is shutting down since revenue isn't covering operating costs, she said.

Spiking costs – especially for transportation and food – drove her to find work.

A big chunk of Riddle's budget goes towards Ubers. Transportation costs, which include mass transit and ride-hailing services like Uber, have increased about 3% since last year, according to data from Labor Department.

In March, Uber and Lyft added $0.45 to $0.50 fuel surcharges per ride to help drivers cover soaring gas prices that reached a national high of $5.02 before settling to $3.91 last month.

"For someone in college relying on Ubers to go everywhere I'm like, 'Dang, I'm paying for that gas,'" said Riddle, who doesn’t own a car and doesn’t feel safe on public transportation.

Loan forgiveness is good: Why you shouldn't scoff at Biden debt relief just because you paid yours off

Eating in the college dining hall keeps costs down but only until it closes – which is at 7 p.m. on weekdays and 6 p.m. on weekends, she said. “After that, you’re on your own.” Riddle often joins friends at McDonald’s, Wendy’s and other nearby fast-food restaurants. “It’s the cheapest thing you can get that’s going to fill you up,” she said.

Riddle shares advice via TikTok videos for college and high school students thinking about applying to college, with a particular focus on fellow first-generation students.

Like Riddle, many of her followers do not have financially savvy family members or those with generational wealth to tap in the event of an emergency, she said.

“Imagine how hard it is for me and other students to want to ask your parents for financial advice but all they can say is, ‘Well ...’” said Riddle, whose mother struggled to make ends meet.

Riddle is reconsidering working during the school week to focus on her studies. She’s keeping an eye on weekend jobs and work she can pick up during school breaks.

She thinks she’ll be able to afford costs that arise in the interim.

“Working, saving up and budgeting is a cycle I’m used to.”

– Elisabeth Buchwald

'You can still use this' Cutting corners at home to keep Oakland business afloat

By 5:30 a.m., six days a week, Eric Huynh is outside a loading station, negotiating with wholesalers for the best deals on seafood, produce and vegetables to fill a truck bound for his family-owned grocery in Oakland's Chinatown a few blocks away.

For the next 12 to 14 hours, he unloads the truck then helps his wife, Finnie Phung, restock outdoor trays on pallets.

The Green Fish Seafood Market has struggled. Income has dropped more than 20% and sales by a similar percentage since the COVID-19 pandemic. Inflation has only added to the couple's woes. Phung said sales from restaurants have fallen about 90% since the pandemic.

On a cloudy weekday, a steady stream of mostly elderly shoppers rotates in and out of the grocery, bags in tow, hunting for deals on fish, from black rock to California sea bass. They check to see if crab, usually $10 a pound, or the lobster, typically $13 a pound but now as high as $18, have come down in price.

Phung said they're doing their best not to pass higher prices on to their customers.

"It’s tough because you don’t want to raise prices, but you want to make something," she said.

The family also is making sacrifices at home.

Each child only got one pair of new shoes for school instead of two and they can participate in just one afterschool program, swimming, instead of having the choice of two.

"We talk to them about it and use the price of gas as an example and how it’s been a dollar, almost two dollars higher than a year ago," Phung said. "So now they pay attention to gas prices and are conscious of saving money."

Back-to-school shopping is more expensive: Here's how much Americans are spending

Phung hopes her children will someday work at the store part-time and eventually take it over. After all, it's their family legacy. The store was passed down to Phung from her parents.

It's also a pact with the community. Many of their elders walk through Chinatown to buy their groceries and support local businesses.

Seniors and poverty: Seniors are the only age group with more poverty. Here's why

Outside the store, Huynh gives a customer a 1-pound bag of green lettuce that's selling for $1.

“I can’t take this Eric,” the customer said.

“You can make almost a week’s worth of salad. Please, I insist,” Huynh said as the customer accepts and hugs Phung.

"Our customers can’t afford to venture out, so we want to be accommodating and fair to them," said Phung, taking a deep breath. "We’re all trying to make it."

– Terry Collins

This article originally appeared on USA TODAY: Food, gas, rent: High prices force Americans to make tough choices

Yahoo Movies

Yahoo Movies