Britain faces four days without post as 115,000 Royal Mail workers strike

Britain’s postal service faces days of paralysis with letters and prescription medicines undelivered after 115,000 Royal Mail workers announced they will strike in just over a fortnight.

The Communication Workers’ Union on Tuesday said members up and down the country will launch industrial action on August 26 and 31, as well as September 8 and 9.

It will be the biggest strike so far in the “summer of discontent” and marks the first time Royal Mail workers have walked out since 2009.

The announcement came after talks about pay and conditions fell apart, with a CWU source accusing company’s bosses of “taking the p—”.

Royal Mail similarly claimed that the union had failed to engage in “meaningful discussions” for the past three months.

Postal workers have demanded a “dignified, proper pay rise” in the face of rampant inflation, rejecting the 5.5pc wage increase offered by the company so far.

Royal Mail’s offer includes a 2pc increase backdated to April 1 that has already been implemented and another 3.5pc rise that would be dependent on improvements in productivity and changes to postal worker rosters.

However, the CWU has said these would amount to a real-terms pay cut with the Bank of England currently predicting inflation will top 13pc in October.

The union is also unhappy about new schedules that would see postal workers asked to work more days of the week and potentially longer hours, to improve the company’s ability to deliver online shopping parcels.

Dave Ward, the general secretary of the CWU, said: "Nobody takes the decision to strike lightly, but postal workers are being pushed to the brink.

"We can't keep on living in a country where bosses rake in billions in profit while their employees are forced to use food banks.

"The CWU's message to Royal Mail's leadership is simple –there will be serious disruption until you get real on pay."

But Royal Mail warned the strike action would cripple the postal service on the days targeted, leaving millions of households waiting for important letters.

A company spokesman said special deliveries, tracked parcels, Covid testing kits and medical prescriptions would be “prioritised” but admitted that the industrial action meant that on-time delivery could not be guaranteed during the industrial action.

Ricky McAulay, Royal Mail’s operations director, said: “After more than three months of talks, the CWU have failed to engage in any meaningful discussion on the changes we need to modernise, or to come up with alternative ideas.

“Royal Mail can have a bright future, but we can’t achieve that by living in the past.

“The CWU’s failure to engage on the changes we need is an abdication of responsibility for the long-term job security of their members.

“We apologise to our customers for the disruption that CWU’s industrial action will cause.”

He added the company was willing to talk further but only about “both change and pay”.

The plans for a national walk out come after CWU members voted overwhelmingly for strike action last month.

The union represents roughly 115,000 of 140,000 Royal Mail staff.

Since then, talks with Royal Mail have been ongoing to try to avert industrial action.

The company has said its offer of a further 3.5pc pay rise is conditional on productivity improvements.

Bosses have argued that more mail needs to be sorted by machine rather than by hand and that postal workers need to be able to offer parcel deliveries on more days of the week, to match competition from rivals as the online shopping boom fuels demand for “next day” packages.

06:57 PM

Wrapping up

That's all from us, thank you for following! Before you go, check out the latest stories from our reporters:

Ukraine war and soaring energy costs to put 240,000 Germans out of work and wipe £220bn off economy

Liz Truss’s tax cuts could trigger a wave of investment into the UK, says L&G chief

06:39 PM

IWG hit by fears over slowdown in demand for flexible office space

One of the world’s largest flexible office providers has lost a tenth of its value after the rise of working from home and recession fears triggered questions about the long-term demand for office space. Lucy Burton has more:

IWG's shares plummeted on Tuesday even though its losses narrowed from £163.3m to £70.2m for the first half of the year.

However, the loss was higher than the City expected and investors were told dividend payments would be kept on hold due to "continuing macroeconomic uncertainties and geopolitical tensions".

Barclays forecast slower growth on the back of the update and RBC called the business a "jam tomorrow story". Shares in IWG dropped 11.4pc.

06:15 PM

Europe gas pares losses as stockpiles rise

European natural gas prices pared earlier losses, with traders assessing rising fuel inventories against worries over possible supply shortages this winter.

Benchmark futures settled 0.5pc lower, after hitting a two-week low earlier. The continent’s storage sites are 72pc full, near the five-year average for this time of year, data from Gas Infrastructure Europe show. Yet, risks remain.

Germany needs to cut gas consumption by 20pc to cope this heating season and next, Klaus Mueller, president of the federal network agency BNetzA, said Tuesday. To help stabilise or even bring down prices, all EU nations should save the vital fuel, he said on ZDF TV.

Gas shipments from Russia via Nord Stream, the main pipeline to the continent, have been broadly stable at around 20pc of the link’s capacity since late-July, when Moscow cut shipments from 40pc.

“The market feels confident that storage facilities will be well full across the continent by late autumn, as is the target from the EU,” analysts at trading firm Energi Danmark said in a note. “However, as flows from Russia remain diminished, there are nonetheless so many fears concerning supply during winter, that the market remains elevated.”

05:46 PM

Liz Truss' tax cuts could trigger a wave of investment into the UK, says L&G boss Nigel Wilson

Liz Truss’ plans to slash taxes could trigger a wave of investment into the UK, the boss of Legal & General has said. Simon Foy writes:

Nigel Wilson, the influential City grandee and chief executive of the UK’s biggest pensions manager, said that cutting taxes on businesses could boost the attractiveness of Britain as a destination for international investors.

"Reducing the tax burden will be seen by international investors that the country is open for business,” he said.

Attracting overseas money could soften the blow as the economy heads into a recession, with the Bank of England predicting the steepest downturn since 2008.

05:20 PM

FTSE 100 ends in the green

The FTSE 100 has hit fresh a two-month peak as investors awaited US inflation data to gauge the pace of interest rate hikes.

The blue-chip index inched up 0.1pc to close at 7,488, its strongest level since June 9.

Global markets slipped ahead of Wednesday's inflation data, with investors waiting to see if the US Federal Reserve might dial down its fight against inflation and provide a better footing for the economy to grow.

"When the economy rolls over, then you might see the CPI come lower. I don't see much optimism on the horizon," said Keith Temperton, sales trader at Forte Securities.

04:56 PM

Goldman Sachs says M&A activity resilient despite challenging environment

Global dealmaking is proving surprisingly resilient to a toxic mix of higher funding costs, slumping management confidence and a raft of economic challenges, according to a Goldman Sachs strategist.

Merger and acquisition activity has held up well this year, despite a less favourable funding environment and as global volumes have come off 2021’s record highs.

A cocktail of rising rates, slowing growth and fears of a looming recession put a huge strain on lending markets, spurring banks and private credit providers to dial back on risk. Companies have been putting excess money raised during the pandemic to work, funding more deals through cash rather than debt.

Strategist Sienna Mori said: “The resilience of M&A appetite in the face of elevated macro risks suggests that managements remain focused on one of the many key lessons of the pandemic: The importance of strengthening and diversifying business mixes in order to withstand large macro shocks."

04:32 PM

Russian oil flows halted through pipeline to central Europe

Europe’s energy security suffered another blow after Russian crude flows through Ukraine to Hungary, Slovakia and the Czech Republic were halted because sanctions prevented payment of a transit fee.

While Russia’s oil-pipeline operator Transneft said there was no effect on the northern leg of the Druzhba pipeline, which runs through Belarus to Poland and Germany, the southern portion of the link was shut down on Aug. 4. Oil prices jumped this afternoon, with Brent crude 1.1pc higher at $97.70 a barrel.

Russia has already blamed international sanctions for curbing flows of natural gas to Europe through the Nord Stream pipeline. Similar disruption to oil flows would deepen the region’s energy crisis, adding to pressure on inflation and amplifying the risk of recession.

Hungary’s fuel supplies would be particularly vulnerable, and Budapest-based refiner Mol said it had initiated talks aimed at restarting the crude flows by paying the transit fee to Ukraine itself. “Although Mol has enough reserves for several weeks, it is working on a solution,” the refiner said in a statement.

Mol’s Slovak unit Slovnaft and Czech crude-pipeline operator Mero CR said in separate statements that they expect flows to be restored within days.

04:11 PM

UK faces winter blackouts as part of emergency plan

The UK is planning for several days over the winter when cold weather may combine with gas shortages, leading to organised blackouts for industry and even households.

Under the government’s latest “reasonable worst-case scenario,” Britain could face an electricity capacity shortfall totaling about a sixth of peak demand, even after emergency coal plants have been fired up, Bloomberg reports.

Under that outlook, below-average temperatures and reduced electricity imports from Norway and France could expose four days in January when the UK may need to trigger emergency measures to conserve gas.

03:58 PM

Handing over

That's all from me today – thanks for following! Giulia Bottaro will take things from here.

03:51 PM

H&T Group cashes in as more Brits sell gold

The UK's largest pawnbroker said it has seen a surge in people selling gold to cash in on higher prices as inflation chips away at disposable incomes.

H&T Group – which also sells pre-owned jewellery and watches – reported that pre-tax profits for the first half of the year jumped 46.2pc from a year earlier to £6.7m, and there was a 68pc increase in retail sales to £20.8m.

It also made £9.4m in net income from other services, driven by buoyant gold purchasing with the price of the metal rising since February and more people selling their items to raise cash.

Shares rose more than 5pc following the half-year results.

03:39 PM

BoE: Virtual worlds championed by Mark Zuckerberg threaten the financial system

The ‘metaverse’ technologies championed by Mark Zuckerberg pose a threat to financial stability, the Bank of England has warned.

Louis Ashworth writes:

A report by the Bank found financial problems within metaverses – a catch-all term for virtual worlds where people interact via digital avatars – could have severe real-world financial consequences if controversial crypto technology is tied to their operations.

It warned that in a future where people have jobs and own swathes of assets in virtual worlds, movements in highly volatile crypto markets could spill out.

Crypto assets have been rocked by a heavy sell-off over recent months, with investors suffering steep losses amid what has been called “crypto winter”. Andrew Bailey, the Bank’s Governor, has warned crypto assets have “no intrinsic value”.

Researchers said a crisis within a “sizeable” cryptoasset-linked metaverse could deal a hit to households and businesses, prompt jobs losses and force some investors into asset “fire sales”.

Such assets include cryptocurrencies such as bitcoin, and non-fungible tokens (NFTs) – a form of collectible verified through a digital ledger.

03:26 PM

Union demands pay rise for Amazon workers after protests

Union bosses have demanded a pay rise for Amazon workers after the US tech giant was hit by a wave of protests over pay.

The GMB Union has it's approached Amazon for talks and asked for a "real terms" pay rise. Regional claims have also been submitted in Coventry, West Midlands and in London.

It follows protests at warehouses across the country last week, with staff walking out from shifts and staging sit-ins in canteens and "go slow" protests.

GMB said Amazon had already moved to discipline workers who took part in the protests.

Andy Prendergast, GMB National Secretary, said:

Amazon workers deserve a decent pay rise. They are the backbone of the company – one of the most profitable on earth.

When the high street was shut down through Covid, Amazon continued to make money. The least it can do is share those profits with their workers.

GMB will continue to fight for every Amazon worker to get fair pay.

03:10 PM

Heathrow owner considers sale of 25pc stake

The owner of Heathrow is said to be considering selling its 25pc stake in the airport.

Ferrovial, the Spanish transport giant, has held preliminary talks with advisers on the future of its holding in Britain's biggest airport, Reuters reports.

It comes amid interest from French private equity firm Ardian, which is exploring a possible joint approach with Saudi Arabia's sovereign wealth fund.

Heathrow is worth about €24.3bn (£20.5bn) including debt, according to JPMorgan analysis, valuing Ferrovial's stake at around €611m.

Heathrow, which was the world's fifth busiest airport last month, was hard hit by Covid lockdowns, but raised its 2022 traffic forecast to 54.4m passengers in June after a rebound in travel demand.

Madrid-based Ferrovial has been invested in Heathrow airport for 16 years and ranks as its single largest investor. Qatar Investment Authority (QIA), which has a 20pc stake, is the second largest.

02:50 PM

London told to brace for hosepipe ban

Londoners have been told to prepare for a hosepipe ban as the capital faces another heatwave.

Thames Water said it could not confirm exactly when the ban would kick in but urged families to use as little water as they need to get by.

A spokesman for the utility said: “Given the long-term forecast of dry weather and another forecast of very hot temperatures coming this week we are planning to announce a temporary use ban in the coming weeks.”

The Health Security Agency has issued a heat-health alert for all regions from midday today until 11pm on August 14, while the Met Office has warned of extreme heat particularly in London and southeast England.

England suffered its driest July in almost 90 years.

South East Water is set to impose a hosepipe and sprinkler ban on customers in Kent and Sussex from August 12 until further notice, following similar moves from Southern Water in Hampshire and on the Isle of Wight.

02:36 PM

Tech stocks drag Wall Street lower

Wall Street has started the day on the back foot as dire forecasts from Micron Technology dragged chipmakers lower, while investors are cautious ahead of tomorrow's inflation data.

The S&P 500 fell 0.2pc, while the Dow Jones was trading marginally lower. The tech-heavy Nasdaq led losses, dropping 0.7pc.

02:20 PM

Price of olive oil to rise by as much as 25pc

The price of olive oil will increase by as much as 25pc within months, one of the UK's largest supermarket suppliers has warned, as the heatwave in Spain hammers production.

Hannah Boland reports:

Extra virgin olive oil was already 7.3pc more expensive in July compared to June, according to the Mintec benchmark prices, but is set to go even higher as supermarket contracts come up for renewal.

Major supplier Acesur, which sells 20,000 tonnes of olive oil in the UK every year, said that price increases for customers could range between 20pc and 25pc. It said the heatwave across Europe had a "drastic" effect on Spain's olive oil production.

The price rise is expected to come through when new contracts are agreed in the next three to four months, according to the BBC.

Spain is responsible for around half of the global production of olive oil, making 1.4m tonnes a year. Acesur said the current forecasts were for this to have dropped to 1m this year.

The heatwave has been sweeping across the continent, with Spain not the only major olive oil producing nation affected. Italy, for example, is suffering from its worst drought in 70 years.

Read Hannah's full story here

01:30 PM

Investment bank Berenberg cuts 5pc of staff

A major European investment bank is axing more than 5pc of employees in London as a recession chill hits the City, reports Simon Foy.

Bosses at Berenberg, Germany’s oldest lender, told staff on Monday that around 30 jobs will be cut as dealmaking dries up and recession fears mount, The Telegraph can reveal.

The bank currently has around 500 employees in London, a Berenberg spokesman said, including administrative staff and those working in its private wealth arm.

Berenberg is one of the first investment banks in the City to trim its headcount as the economic outlook darkens. The Bank of England warned last week that the UK is set to face a 15-month recession from the end of this year.

Stock market listings and equity raises — both big revenue drivers for boutique investment banks like Berenberg — have already ground to a halt since Russia’s invasion of Ukraine at the end of February.

12:41 PM

Average mortgage terms hits record 30 years

UK home buyers are taking on mortgages that will take longer than ever to pay off as they struggle with sky-high house prices.

The average term of a mortgage taken out in June hit a record 30 years, according to data from UK Finances. That's compared to 25.5 years in 2005 when the lobby group began compiling the data.

House prices have surged to ever more unaffordable levels, with booming demand during the pandemic propped up by shortages of supply.

Meanwhile, mortgage approvals fell in June as the Bank of England raises interest rates to tackle surging inflation.

12:25 PM

Liz Truss: I still favour tax cuts over energy bill support

Tory leadership frontrunner Liz Truss has said she still favours tax cuts to grow the economy instead of providing direct support to households facing unprecedented rises in energy bills.

Charities, business groups and politicians have called on Ms Truss and rival Rishi Sunak to set out how they would help Britons cope with a forecast 82pc rise in energy prices in October.

Asked if she would provide direct support to households, Ms Truss told reporters: "What I don't believe in is taxing people to the highest level in 70 years, and then giving them their own money back."

12:13 PM

Alibaba cut staff by nearly 10,000 in three months

Chinese ecommerce giant Alibaba made 9,241 employees redundant in just three months as it grapples with rising costs and political tensions.

The company said it had just over 245,000 workers at the end of June as it cut back during its first ever quarter of revenue contraction.

Alibaba also reduced its workforce by 4,375 in the first three months of the year.

The cuts reflect wider efforts by global tech companies to rein in spending amid rising inflation, material costs and political tensions.

US firms like Apple, Google owner Alphabet and Meta have slowed hiring, while Alibaba's closest equivalent Amazon has cut around 100,000 jobs.

12:02 PM

US futures slip after tech sell-off

US futures slipped this morning as investors keep an eye on company earnings as well as inflation data due tomorrow.

Wall Street closed in the red last night, driven by a sell-off in tech stocks after Nvidia's revenue fell short of expectations.

Focus is turning to the question of whether US inflation may have peaked in June as economists project the biggest drop in more than two years for July.

Futures tracking the S&P 500 slipped 0.1pc, while the Dow Jones was little changed. The tech-heavy Nasdaq led declines with a fall of 0.4pc.

11:50 AM

Domino's leaves Italy after locals turn up their noses

Domino's efforts to gain a foothold in the home of pizza have proved short-lived as Italians favoured their own offering over American imports.

The last of Domino's 29 branches have now closed after the company started operations in the country seven years ago, Bloomberg reports.

It borrowed heavily for its plans to open 880 stores, but faced tough competition from local restaurants expanding into delivery services during the pandemic.

The US chain entered Italy in 2015 through a franchising agreement with ePizza and planned to distinguish itself by providing a national delivery services, as well as American-style toppings including pineapple.

ePizza said: "We attribute the issue to the significantly increased level of competition in the food delivery market with both organised chains and 'mom & pop' restaurants delivering food, to service and restaurants reopening post pandemic and consumers out and about with revenge spending."

11:33 AM

Cost-of-living support only covers half of rise in poorest households’ bills

The amount of support offered by the Government to tackle the cost-of-living crisis covers less than half the increase in prices households face this year, according to new analysis.

The Joseph Rowntree Foundation found that the poorest families will shoulder a £2,500 increase in costs, versus just £1,200 pledged.

The charity urged the Government to double support for the poorest families as it warned the looming price rises will mean "unnecessary suffering on an immense scale for millions".

Katie Schmuecker at the Joseph Rowntree Foundation said:

Last week the nation was confronted by sobering, and for many frightening predictions from the Bank of England about the months to come.

Now that this is rightly at the centre of the battle for Number 10, the political debate must lead to swift action which matches the scale of the coming emergency.

Failure to respond will put many families beyond having to choose between heating and eating in the run up to Christmas, they will be unable to afford either.

11:13 AM

Pound edges higher with rate rises in focus

Sterling has edged higher against the dollar, with the outlook for interest rate rises in focus after a Bank of England official forecast further increases.

Deputy Governor Dave Ramsden told Reuters the Bank will probably have to raise interest rates further from their current 14-year-high to tackle inflation pressures.

The MPC lifted rates by a large 50 basis points last week, but warned of an incoming recession.

The pound was up 0.4pc against a slightly weaker dollar at $1.2128. Against the euro, it was largely steady at 84.45p.

10:59 AM

Martin Lewis: Energy crisis will leave many 'destitute'

Consumer expert Martin Lewis has described the latest energy price cap forecasts as "tragic", saying they will leave many households "destitute".

He said the surge will not only wipe out the £400 support offered to all homes, but even the £1,200 package offered to the poorest Britons.

Mr Lewis warns the Government can't ignore this "portentous national cataclysm" and must act today to avert a crisis.

That rise alone swallows up not just £400 help for all homes,but even the £1,200 for the poorest

This will leave many destitute. Tax cuts won't help poorest incl many elderly & disabled who've higher usage

Cutting green levy'd be just tiny sticking plaster on a gaping wound...— Martin Lewis (@MartinSLewis) August 9, 2022

10:47 AM

Families slash holiday and shopping spending as inflation crisis batters economy

Families slashed their spending on holidays, shopping and going out in July as the economy is battered by the highest inflation in 40 years.

Tom Rees and Szu Ping Chan have more:

New retail sales and card data indicated that spending is falling in real terms as Britain’s biggest business lobby group called for action to help households, and hit out at a “power vacuum” in Government.

Debit and credit card data from Barclaycard showed a 7.7pc rise in overall spending in July compared to a year earlier but the figures have been artificially inflated by soaring prices.

The card data suggests a 2pc fall in spending in real terms if inflation for the month hits 9.7pc as expected, according to Martin Beck, chief economic advisor to the EY Item Club.

The figures added to growing evidence of belt tightening by households as a looming record fall in incomes forces families to cut back.

The Bank of England expects the economy to fall into a recession lasting more than a year after another shock to incomes from soaring energy bills.

New data from the British Retail Consortium (BRC) revealed a 2.3pc year-on-year rise in retail sales in July, but the industry group added that the figures “masked a much larger drop in volumes once inflation is accounted for”. Non-food retail sales in the three months to July were down 2pc as shoppers cut back.

10:21 AM

UK flight prices surge 30pc amid travel chaos

Britons booking a getaway in some of Europe's most popular holiday destinations this summer are paying almost a third more for their flights.

Fares in the first week of August – the peak month for travel – were up 30pc on average for the top 36 routes compared to pre-pandemic levels, according to online travel agency Kayak.

Short-haul trips are typically 40pc higher as the school holidays triggers an exodus of families.

Flights from London to Athens and Faro in Portugal's Algarve saw the biggest increases, selling for more than twice the cost in 2019.

Services to Larnaca in Cyprus and Alicante on Spain's Costa Blanca costing around 90pc more.

The sharp rise in prices comes amid booming demand after the pandemic and high oil prices, as well as limits on airline capacity imposed by airports.

As well as paying more, passengers have been subjected to weeks of delays and cancellations caused by widespread staff shortages and strikes.

10:04 AM

Campaigners call for 25p fuel duty cut

Campaigners have called for a 25p cut to fuel duty to help motorists struggling with surging bills.

FairFuelUK said fuel duty should be cut by "at least" 20p to 25p a litre, reflecting similar moves across Europe.

It said a barrel of Brent crude oil was now below £80, meaning there should be a "considerable" reduction in pump prices.

But it said that when the oil price was at a similar level back in February, pump prices were for petrol 31.4p lower and diesel 38.1p less than they are now.

As a result, FairFuelUK said the Government was "wallowing" in an extra £30m of VAT a day and an average family was paying £15 to £20 more than necessary to fill up now compared to in February.

Robert Halfon MP, vice chair of the FairFuelUK APPG, said:

This is literally highway robbery from the big oil companies. We need PumpWatch now, to ensure that motorists have a proper watchdog to investigate what appears to be racketeering.

09:51 AM

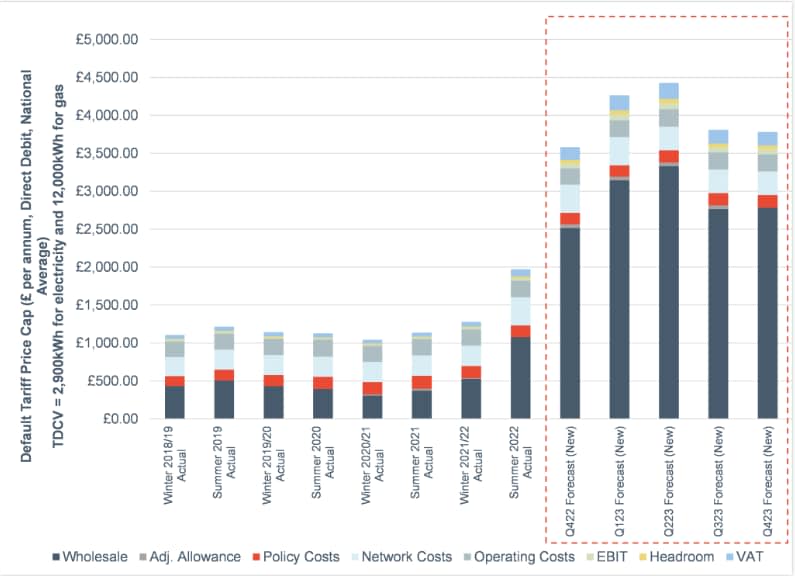

Energy price cap forecast to hit £4,200 in January

There are new forecasts out for the energy price cap, and it's not a pretty sight.

The predictions from Cornwall Insight show energy bills will have risen by over £650 by January, meaning a typical household will pay the equivalent of £4,266 a year in the first quarter.

Forecasts for the October cap have also seen a rise, going up by over £200, and with predictions for an average bill now sitting at £3,582.

Cornwall Insight said the latest increase in forecasts reflected the recent rise in wholesale prices, as well as a change in the way Ofgem calculates the price cap.

The analysts explain:

In its initial proposals from May, the regulator stated that an element of supplier costs associated with wholesale market hedging would be explicitly included within the cap methodology and would be recoverable over a 12-month period.

However, in the consultation documents released last week, it was confirmed that these costs would be recoverable over a six-month period – resulting in higher bills than previously forecast for the crucial January cap.

09:36 AM

Felixstowe strike to go ahead as talks end without deal

An eight-day strike at the Port of Felixstowe will go ahead later this month after talks with the Unite union ended without a deal.

More than 1,900 workers at Felixstowe plan eight days of strikes from August 21 in a dispute over pay, threatening the arrival of goods.

A spokesman for Hutchison Ports, which operates Felixstowe, said: "We are disappointed and regret that despite our best efforts we have still been unable to reach an agreement with the hourly branch of Unite."

The port had previously increased its pay offer to 7pc from 5pc and said it had now also offered a lump sum of £500 on top.

The spokesman added: "The hourly branch of Unite has again rejected the port’s improved position and refused to put it to its members. The union has rejected the company's offer to meet again."

09:24 AM

WhatsApp mirrors Snapchat with new screenshot-blocking feature

WhatsApp is bringing in a new screenshot-blocking feature that resembles Snapchat to tempt privacy-conscious users back to the service as parent company Meta struggles with shrinking sales.

Gareth Corfield has the story:

The changes include the ability to block screenshots of time-limited messages, hiding one’s online presence from other WhatsApp users and leaving group chats without notifying others.

WhatsApp owner Meta’s chief executive Mark Zuckerberg said: “We'll keep building new ways to protect your messages and keep them as private and secure as face-to-face conversations.”

The ability to block screenshots mirrors one of the main functions of Snapchat, which alerts the sender of a time-limited photo if it is screenshotted before it self-deletes.

Joseph Teasdale, head of tech at Enders Analysis, said the changes were “fairly minor product updates designed to keep WhatsApp competitive”.

He added: “Mark Zuckerberg seems to be trying to return to the founder-led tech startup model of placing huge, bold bets on the future. The question now is, how easy is it to make those big bets work when you're not talking about a nimble startup, but a $500bn behemoth?”

09:11 AM

Nurses in England and Wales to vote on strike

Hundreds of thousands of nurses in England and Wales will vote next month on whether to strike in a row over pay, threatening further disruption to an already struggling NHS.

A strike ballot for nurses will open on September 15 and close on October 13, the Royal College of Nursing union said.

RCN's Wales director Helen Whyley told Times Radio more than 250,000 nurses would be balloted. If they vote to strike, it would be the first time in the RCN's 106-year history that nurses in England and Wales have staged a walkout.

The union has said a £1,400 pay rise announced by the Government last month is inadequate to cushion the impact of rising consumer prices, with the RCN's General Secretary Pat Cullen previously calling it a "national disgrace".

The strike threat comes as the NHS faces a serious staffing crisis with more than 100,000 vacancies, while millions of patients are on waiting lists for hospital treatment due to backlogs caused by the pandemic.

08:57 AM

IWG shares tumble as recovery falters

Office space provider IWG is the biggest faller this morning after its post-pandemic recovery was held back by inflationary pressures and continued Covid woes.

Shares dropped 14.5pc – their biggest fall since June 2021 – with analysts at RBC describing the figures as "light".

The company was hit by rising costs that have squeezed margins, while lockdowns in some of its markets continue to weigh.

08:49 AM

FTSE risers and fallers

The FTSE 100 is holding its ground close to a two-month high as investors await US inflation data to gauge the pace of future interest rate rises.

The blue-chip index was flat after closing at its strongest level since June 9 yesterday.

Markets are on edge ahead of inflation figures due tomorrow, with investors waiting to see if the US Federal Reserve will dial down its interest rate rises to boost growth.

Abrdn was the biggest laggard, dropping as much as 4.6pc after it reported lower-than-expected profit. InterContinental Hotels Group was also in the red as its first-half revenue missed estimates.

The FTSE 250 was also trading flat, with office space provider IWG tumbling almost 13pc after its results were hit by inflation woes and Covid restrictions.

08:31 AM

Bellway cuts house prices outlook as property boom ends

Housebuilder Bellway has posted a record first half for revenues, but slashed its outlook for property prices over the year ahead as the housing boom comes to an end.

The FTSE 250 company said housing revenues rose 13pc to more than £3.5bn in the year to the end of July, with housing completions up 10.5pc to hit another all-time high at 11,198.

Bellway said average selling prices rose 2.6pc to £314,400 over the year, but revealed it now expects this to fall in the year to next July, to just over £300,000.

Bosses said this was due to changes in the types of houses sold and location, but it comes amid wider signs the market is cooling as interest rates rise and households face a squeeze on incomes.

08:24 AM

Abrdn assets drop after Lloyds pulls £24.4bn

Abrdn saw its assets drop in the first half of the year after Lloyds transferred a final batch of funds out of the manager.

The fund manager lost £24.4bn of cash from a mandate with Lloyds that it lost in the wake of its merger in 2017.

Total net outflows were £35.9bn in the period, which dragged down assets under assets and administration to £508bn from £542bn.

Abrdn reached a settlement with Lloyds in 2019 after one of the most high-profile disputes in the UK fund management industry’s history.

The bank wanted to pull a £104bn mandate from Standard Life when it merged with Aberdeen Asset Management in 2017, citing a conflict of interest with its own business.

Lloyds ultimately agreed to take the funds out in portions, agreeing to leave the last part until this year.

08:11 AM

Holiday Inn owner cashes in on travel bounceback

The owner of Holiday Inn has posted a surge in profits thanks to a rebound in demand for business and leisure travel.

Intercontinental Hotels Group reported pre-tax profits of $299m (£248m) in the first half of the year, up from £67m a year earlier. Profits more than doubled to $361m.

In the UK, revenue per available room edged closer to pre-pandemic levels, down just 2pc in the second quarter compared to 2019.

IHG pinned the positive performance on a rebound in tourism in London, although revenue per room was still down 10pc.

The hotel chain said its sites were grappling with surging costs and difficulties hiring staff, but insisted it could use its scale to offset this.

The group also announced it was resuming its interim dividend at a level that is 10pc higher than the last time it was paid out in 2019, while it also unveiled a $500m share buyback.

08:03 AM

FTSE 100 opens flat

The FTSE 100 is treading ground at the open after a sell-off in tech stocks dragged Wall Street lower overnight.

The blue-chip index was unchanged at 7,481 points.

07:55 AM

'Tough' trading at John Lewis

Dame Sharon also admitted it had been a "tough" period for John Lewis as consumer sentiment plummeted amid rising inflation.

She said the retail giant had doubled its financial assistance fund – which allows workers to apply for grants and loans if they're struggling to pay bills – from £400,000 to £800,000.

It also handed out a 3pc bonus this year to its 800,000 workers and increased wages by 2pc.

But that's well below the current inflation rate of 9.4pc and price rises are set to peak above 13pc later in the year.

Dame Sharon said the department store had to "try to balance how do we ensure our partners are able to cope with the cost of living whilst also thinking about the affordability of pay for the business".

She added: "I think the same dilemmas that the partnership faces are the same dilemmas that the whole of the economy faces."

07:45 AM

John Lewis boss: I've never seen the economy like this

John Lewis boss Dame Sharon White has sounded the alarm over the UK economy and warned that tackling labour shortages was key to averting an ever deeper crisis.

Here's more from her interview with the BBC:

I guess I would encourage... any government to really think much more about how to we encourage more people back into work.

There's not a business in the UK that's not finding it very difficult to recruit at the moment because there are so many more jobs and so far fewer people looking for work. It's a big issue...

I've never seen anything quite like the economic environment we have at the moment.

I think the big worry that everybody has is inflation combined with low growth, low productivity. So I think the big focus for all of us is how do we avoid stagflation?

How do we avoid the UK becoming Japan with very low, very persistently low rates of productivity and very low persistent rates of growth? To come out of that you have got to get businesses investing.

07:40 AM

John Lewis boss urges people back to work

Good morning.

People who retired during the pandemic should go back to work to help the ailing economy, the boss of John Lewis has said.

Dame Sharon White urged the Government to encourage people – mainly in their 50s – who've stopped working to rejoin the workforce amid fears a labour shortage will keep driving up inflation.

She told the BBC: “Regardless of what has happened coming out of Covid, if the labour market is that tight, if we continue to have far fewer people in work, looking for work – you’ve inevitably got more inflation and more wage inflation.”

The John Lewis chairman said she'd never seen “such a combination of some very difficult factors” impacting the economy during her career and said it was crucial Britain avoided a period of stagflation.

She said introducing flexible retirement plans and skills courses for older workers to retrain in different jobs could encourage people back into work.

5 things to start your day

1) How Britain’s next Prime Minister could prevent catastrophic energy bills The Bank of England expects rising costs to force the UK into a recession

2) Families slash holiday and shopping spending as inflation crisis batters economy Businesses attack 'power vacuum' in Government as cost of living crisis begins to take its toll

3) ‘Catastrophic’ ferry failure by Nicola Sturgeon leaves Scottish islanders rationing Confidence in the government ‘shattered’ after shops forced to ration essential items

4) Billionaire media dynasty snaps up news start-up Axios for $525m Cox family will spend $25m on expanding reach of digital news outfit that clashed with Donald Trump

5) IBM accuses start-up of stealing secret computer tech Company alleged that Winsopia posed as a genuine customer to copy the tech giant's software

What happened overnight

Asian shares were down this morning as financial markets fretted about persistent global cost pressures, with investors turning their focus this week to US inflation data and the prospects for further aggressive Federal Reserve rate hikes.

Early in the Asian trading day, MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.2pc. The index is up 0.5pc so far this month. US stock futures rose 0.07pc.

Japan's Nikkei slid 0.81pc while Australian shares were flat.

China's blue-chip CSI300 index was down 0.31pc in early trade. Hong Kong's Hang Seng index opened 0.12pc lower.

Coming up today

Corporate: Abrdn, InterContinental Hotels Group, IWG, Just Group, Legal & General, TI Fluid Systems (interims); Bellway (trading update)

Economics: Non-farm productivity (US), unit labour costs (US)

Yahoo Movies

Yahoo Movies