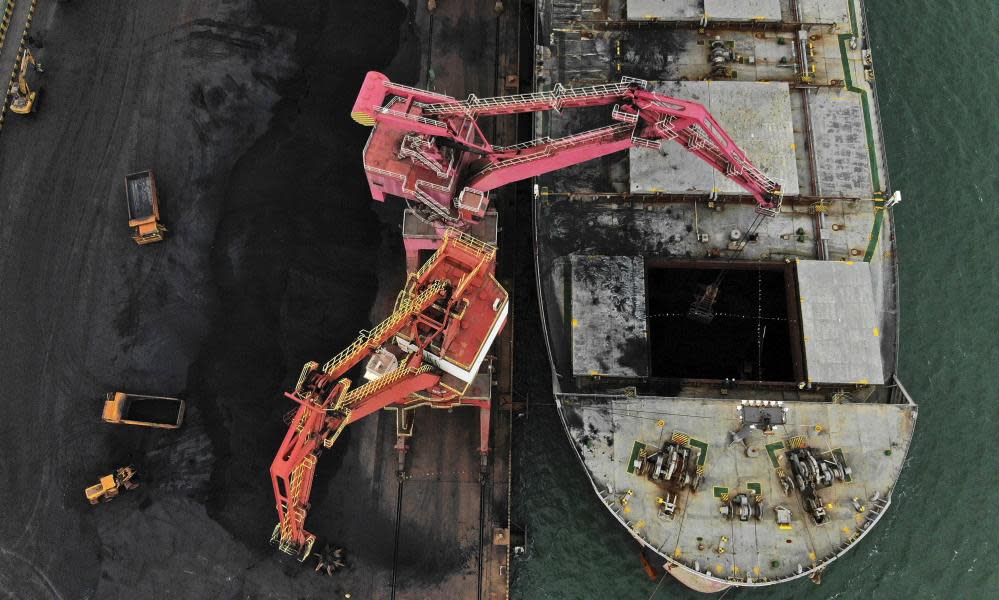

Australian coal shipment to arrive at Chinese port as unofficial import ban ends

Australian coal cargoes are scheduled to start arriving at Chinese ports on Wednesday, unwinding an unofficial ban imposed amid fraying bilateral relations two-and-a-half years ago.

The resumption of the bilateral coal trade marks a significant improvement in relations, which hit a low point at the start of the pandemic after Australia pushed for an independent investigation into the origins of Covid-19, angering Beijing officials.

China imposed official and unofficial sanctions on a range of Australian products, including wine, lobsters, timber and barley. It left more valuable commodities such as iron ore, gas and wheat untouched.

Related: Australian and Chinese trade ministers meet for first time in three years

A bulk carrier, Magic Eclipse, was loaded with almost 72,000 tonnes of coking coal at Hay Point, Queensland, last month. It was due to arrive at Zhanjiang, in Guangdong province, on Wednesday, vessel tracking data shows.

The Global Times, a Chinese state tabloid, said the cargo would be delivered to a facility run by Baoshan Iron & Steel. There were three other Australian coal cargoes headed to China, Bloomberg reported.

The Australian government is understood to view the coal shipments, as well as progress on lobster and timber exports, as positive signs, although it is still pursuing a breakthrough on other affected sectors.

Sources said the government saw Monday’s meeting between the trade minister, Don Farrell, and Chinese commerce minister, Wang Wentao, as a good first step but believed the process of resolving the trade tensions would take some time. Farrell was due to travel to Beijing soon to continue talks.

Sign up for Guardian Australia’s free morning and afternoon email newsletters for your daily news roundup

While the virtual meeting did not produce a breakthrough, Farrell said the talks were “another important step in the stabilisation of Australia’s relations with China”. It was the first meeting between an Australian trade minister and a Chinese commerce minister in three years.

A spokesperson for the Chinese embassy in Canberra said it would work with Australia to develop economic and trade relations that benefit both nations.

“With joint efforts from both China and Australia, this meeting was an important step forward for China-Australia economic and trade relations back on the correct track,” the spokesperson said.

One coal trader told the Guardian the sector would closely watch how long it took customs officials to clear the shipments, which would show whether the trade could resume in earnest.

In 2020, dozens of Australian coal ships were left stranded off China’s coast after the unofficial ban was imposed without warning. Prices for thermal and coking coal, used for heating and steel production respectively, have since rallied due to supply disruptions in Russia and strong Chinese demand.

UBS said in a report that the bilateral coal trade would take time to rebuild given Australian exporters had contracts with new markets.

“It will take time for trade patterns to realign once more, with Chinese purchases in the short term likely to be sourced from spot markets only,” UBS said.

Since banning coal from Australia, China has had to source supplies from more distant sources or increase its reliance of lower-quality coal from Chinese mines.

Paul Flynn, the managing director at Whitehaven Coal, one of Australia’s largest producers, told investors last month that the easing of pandemic restrictions in China would support increased demand.

“We do think once the Covid restrictions in China, and then China opening up more generally, will put a bit more momentum into the market,” he said.

The Chinese curbs hit some of Australia’s niche sectors hard, given their reliance on the bilateral trade.

The four-million-tonne log timber trade with China ground to a halt after Beijing said it found pests in shipments in an allegation disputed by the timber industry.

Meanwhile, tonnes of live lobsters were stuck at Chinese clearing facilities and wine routes closed almost overnight.

Australia also has proceedings before the World Trade Organization disputing claims by China it had dumped cut-price barley into its market; an issue that would likely need to be resolved before that grain trade reopens.

A second WTO application challenges China’s hefty tariffs on Australian wine. Both WTO panel decisions are due this year.

Yahoo Movies

Yahoo Movies